NetSpend 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

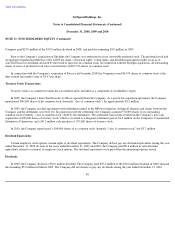

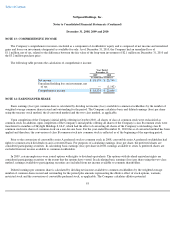

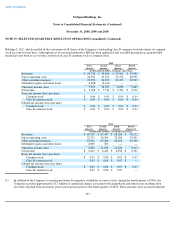

NOTE 14: EARNINGS PER SHARE (Continued)

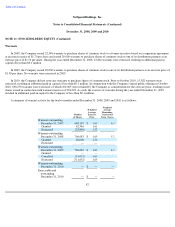

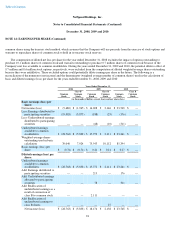

NOTE 15: INCOME TAXES

The components of the provision for income taxes are as follows for the years ended December 31, 2008, 2009 and 2010:

95

Years Ended December 31,

2008 2009 2010

Common

Stock

Class B

Common

Stock Common

Stock

Class B

Common

Stock Common

Stock

Class B

Common

Stock

(in thousands of dollars, except share and per share data)

Weighted-average shares

outstanding used in basic

calculation

39,040

7,924

75,543

10,112

85,394

—

Weighted average effect of

dilutive securities:

Conversion of class B to

common stock

outstanding

—

—

10,112

—

—

—

Options

—

—

615

—

3,045

—

Warrants

—

—

370

—

384

—

Restricted stock

—

—

93

93

168

—

Weighted-average shares

outstanding used in

diluted calculation

39,040

7,924

86,733

10,205

88,991

—

Diluted earnings (loss) per

share

$

(0.74

)

$

(0.74

)

$

0.21

$

0.21

$

0.27

$

—

Year Ended December 31,

2008 2009 2010

(in thousands of dollars)

Income tax provision

Current

Federal

$

4,624

$

9,860

$

13,664

State

194

1,040

1,193

Total current

4,818

10,900

14,857

Deferred

Federal

2,516

1,614

(1,852

)

State

(27

)

(11

)

347

Total deferred

2,489

1,603

(1,505

)

Total provision

$

7,307

$

12,503

$

13,352