NetSpend 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

While we believe that our GPR cards comply with the interim final rule in all respects, the Department of the Treasury could change the rule in

light of the comments it receives during the public comment period in a manner that would prohibit the electronic deposit of federal benefits,

wages and tax refunds onto our GPR cards, which would result in a material adverse impact on our revenues.

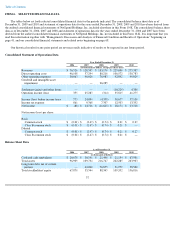

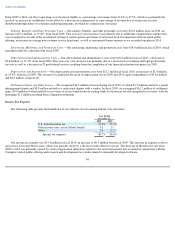

Key Business Metrics

As a leading provider of GPR cards and related alternative financial services to underbanked consumers, we evaluate a number of business

metrics to monitor our performance and manage our business. We believe the following metrics are the primary indicators of our performance.

Number of Active Cards —represents the total number of our GPR cards that have had a PIN, or signature-based purchase transaction, a

load transaction at a retailer location or an ATM withdrawal within the previous 90 days. We had approximately 1.6 million, 1.9 million and

2.1 million active cards as of December 31, 2008, 2009 and 2010, respectively.

Percentage of Active Cards with Direct Deposit —represents the percentage of our active cards that have had a direct deposit load within

the previous 90 days. The percentage of our active cards that were direct deposit active cards as of December 31, 2008, 2009 and 2010, was

22.9%, 27.6% and 34.2%, respectively.

Gross Dollar Volume (GDV) —represents the total dollar volume of debit transactions and cash withdrawals made using our GPR cards.

Our gross dollar volume was $5.7 billion, $7.6 billion and $9.8 billion for the years ended December 31, 2008, 2009 and 2010, respectively.

Approximately 53.5%, 64.4% and 71.8% of the gross dollar volume for the years ended December 31, 2008, 2009 and 2010, respectively, was

made using active cards with direct deposit.

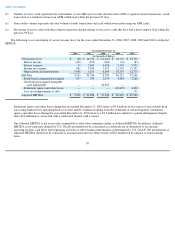

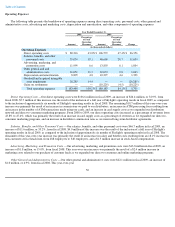

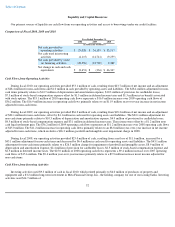

Key Components of Our Results of Operations

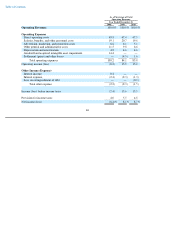

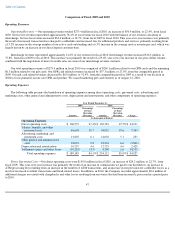

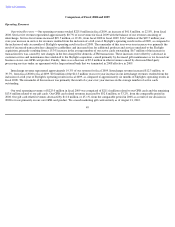

Operating Revenues

Our operating revenues primarily consist of compensation for the services we provide to our issuing banks resulting from service fees and

interchange revenue.

Cardholders are charged fees in connection with the products and services provided, as follows:

• Transactions—Cardholders are typically charged a fee for each PIN and signature-based purchase transaction made using

their GPR cards, unless the cardholder is on a monthly or annual service plan, in which case the cardholder is instead charged a

monthly or annual subscription fee, as applicable. Cardholders are also charged fees for ATM withdrawals and other

transactions conducted at ATMs.

• Customer Service and Maintenance—Cardholders are typically charged fees for balance inquiries made through the Company's

customer service. Cardholders are also charged a monthly maintenance fee after a specified period of inactivity.

• Additional Products and Services—Cardholders are charged fees associated with additional products and services offered in

connection with certain of our GPR cards, including overdraft protection through our issuing banks, a variety of bill payment

options, custom card designs, and card-to-card transfers of funds through our customer service.

• Other—Cardholders are charged fees in connection with the activation of our GPR cards and gift cards at retailers. We ceased

marketing gift cards in August 2010.

Our operating revenues also include fees charged to retail distributors in connection with the reload of our GPR cards at retailers, fees

charged in connection with a third party processing services

43