NetSpend 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

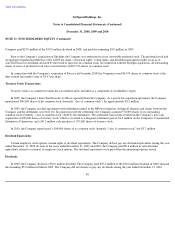

NOTE 12: SHARE BASED PAYMENT (Continued)

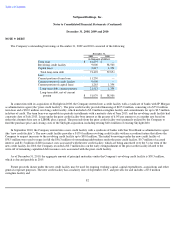

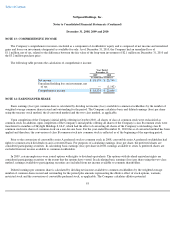

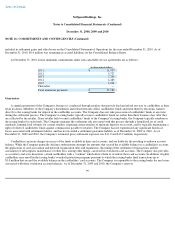

Options with the following characteristics were outstanding as of December 31, 2010:

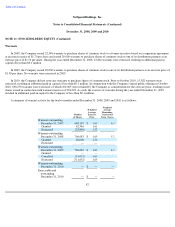

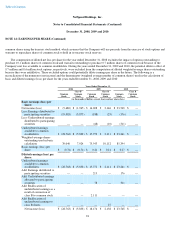

Assumptions for Estimating Fair Value of Stock Option Grants

Through December 31, 2007, the Company used the Black-Scholes option pricing model for determining the estimated fair value for

stock-based awards. Beginning in January 2008 and going forward, the Company used the Binomial Lattice model for determining the

estimated fair value for stock option awards as the Company has determined the model best reflects the characteristics of the employee share

options in estimating fair value, particularly in light of the complexity of the performance awards issued in 2008 and 2009. The Binomial

Lattice model requires analysis of actual exercise behavior data and a number of assumptions including expected volatility, risk-free interest

rate, expected dividends, option cancellations, and forfeitures.

The following table summarizes the assumptions used to value options issued for the years ended December 31, 2008, 2009 and 2010:

The volatility assumption is based on the historical volatilities of comparable public companies. The dividend yield assumption is based

on the Company's expectation of future dividend payouts. The expected term of employee stock options represents the weighted average period

that the stock options are expected to remain outstanding. The Company derived the expected term assumption based on its historical

experience, while giving consideration to options that have lives less than the contractual terms and vesting schedules in accordance with

guidance set by the FASB. The risk-free interest rate assumption is based upon observed interest rates appropriate for the term of the

Company's employee stock options.

91

Exercise Prices Number of

Shares

Weighted

Average

Remaining

Contractual

Life (Years)

Weighted

Average

Exercise

Price Number

Exercisable

Weighted

Average

Exercise

Price

$0.25

-

$ 3.47

2,895,108

7.3

$

3.00

1,150,983

$

2.31

3.53

5,038,524

7.2

3.53

1,551,062

3.53

3.78

2,480,100

9.3

3.78

—

—

11.00

571,874

9.8

11.00

3,052

11.00

14.70

50,000

9.9

14.70

—

—

11,035,606

7.8

$

3.88

2,705,097

$

3.02

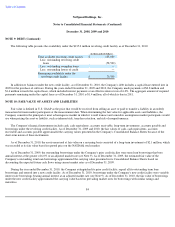

2008 2009 2010

Expected volatility

44.5%

-

48.8%

59.8%

51.2%

-

58.4%

Expected dividend yield

—

—

—

Expected term

6.0

-

9.3 years

7.7

-

9.4 years

6.0

-

8.5 years

Risk free rate

2.6%

-

4.0%

3.3%

2.6%

-

3.8%

Weighted average fair value of options at grant

date

$1.64

$2.13

$3.30