NetSpend 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART I

ITEM 1. BUSINESS

Overview

NetSpend is a leading provider of general-purpose reloadable prepaid debit cards, or GPR cards, and related alternative financial services

to underbanked consumers in the U.S. We believe we are one of the largest dedicated providers of GPR cards in the U.S., with approximately

2.1 million active cards as of December 31, 2010 and a gross dollar volume of debit transactions and cash withdrawals of $9.8 billion for the

twelve months ended December 31, 2010. We primarily focus on the estimated 60 million underbanked consumers in the U.S. who do not have

a traditional bank deposit account or who rely on alternative financial services.

Our GPR cards are tied to FDIC-insured depository accounts and can be used to make purchase transactions at any merchant that

participates in the MasterCard, Visa or PULSE networks and to withdraw funds at participating automated teller machines, or ATMs. The

additional features we offer to our cardholders include direct deposit, interest-bearing savings accounts, bill pay and card-to-card transfer

functionality, personal financial management tools and online and mobile phone card account access. We market our cards through multiple

distribution channels, including contractual relationships with retail distributors, direct-to-consumer and online marketing programs, and

contractual relationships with corporate employers. As of December 31, 2010, we marketed our GPR cards through approximately 750 retail

distributors at approximately 39,000 locations and offered our cardholders the ability to reload funds onto their cards at over 100,000 locations.

Market Opportunity

Prepaid Cards

The prepaid card market is one of the fastest growing segments of the payments industry in the U.S. This market has experienced

significant growth in recent years due to consumers and merchants embracing improved technology, greater convenience, more product choices

and greater flexibility. Within the prepaid card market, which includes branded and private label gift cards, GPR cards, payroll cards, travel

cards, college campus cards and teen spending cards, one of the fastest growing segments is GPR cards. A GPR card, typically branded with

the MasterCard or Visa logo, is an "open-loop" prepaid debit card that provides cardholders the ability to load and reload funds onto their cards

and make purchase transactions at any merchant that participates in the MasterCard, Visa or PULSE network, as well as to withdraw funds

from participating ATMs. GPR cards such as NetSpend's have the same functionality as bank debit cards, serving as access devices to an

FDIC-insured depository account with a bank. NetSpend is one of the most established providers of GPR cards, having marketed GPR cards

since our inception.

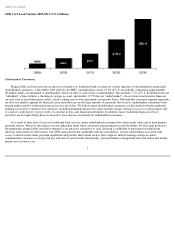

Mercator Advisory Group estimates the total loads on open-loop prepaid debit cards in 2010 to be $165.3 billion, and forecasts total loads

to grow at a compound annual growth rate of 35.6% from 2009-2013. Mercator estimates that of those loads in 2010, $42.1 billion was loaded

on GPR cards and that total loads on GPR cards will grow at a compound annual growth rate of 63.0% from 2009-2013, reaching an estimated

$201.9 billion in load volume in 2013.

2