NetSpend 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

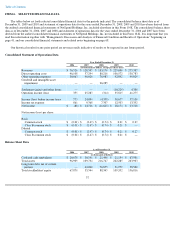

Other Financial and Operating Data

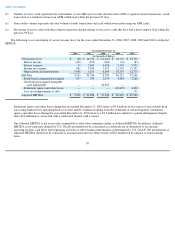

(1) We use a non-GAAP financial metric that we label "Adjusted EBITDA" to evaluate our financial performance. We compute Adjusted

EBITDA by adjusting net income or net loss to remove the effect of income and expenses related to interest, taxes, depreciation and

amortization ("EBITDA"), and then adjusting for stock-based compensation, and non-recurring gains and losses. We believe that

Adjusted EBITDA is an important metric for the following reasons:

• It provides a meaningful comparison of our operating results over several periods because it removes the impact of income and

expense items that are not a direct result of our core operations, such as goodwill and intangible impairments, legal settlements

and one-time settlement gains;

• We use it as a tool to assist in our planning for the effect of strategic operating decisions and for the prediction of future

operating results;

• It functioned as a threshold target for our company-wide employee bonus compensation; and we use it to evaluate our capacity

to incur and service debt, fund capital expenditures and expand our business.

(2) In addition to Adjusted EBITDA, we use a second non-GAAP financial metric that we label "Adjusted Net Income" to evaluate our

financial performance. We compute Adjusted Net Income by adjusting net income or net loss to remove tax-effected amortization

expense, stock-based compensation and other non-recurring gains and losses and we believe it is an important metric that is useful to

our board of directors, management and investors for the following reasons:

• Assets being depreciated will often have to be replaced in the future and Adjusted EBITDA does not reflect any expenditure for

these items;

• Adjusted EBITDA does not reflect the significant interest expense, or the payments necessary to service interest payments on

our debt;

• Adjusted Net Income provides a meaningful comparison of our operating results over several periods because it removes the

impact of income and expense items that are not a direct result of our core operations, such as goodwill and intangible

impairments, legal settlements and one-time settlement gains; and

• We believe Adjusted Net Income measurements are used by investors as a supplemental measure to evaluate the overall

operating performance of companies in our industry.

By providing these non-GAAP financial measures, together with the below reconciliations, we believe we are enhancing

investors' understanding of our business and our results of operations, as well as assisting investors in evaluating how well we

are executing strategic initiatives.

38

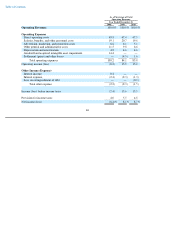

Year Ended December 31,

2006 2007 2008 2009 2010

(dollars in thousands)

(unaudited)

Adjusted EBITDA(1)

$

5,200

$

31,288

$

37,343

$

40,367

$

65,568

Adjusted net income(2)

$

(458

)

$

16,644

$

7,800

$

16,854

$

33,700

Number of active cards (at

period end)(3)

861,115

1,188,201

1,577,767

1,868,341

2,100,179

Gross dollar volume(4)

$

2,357,852

$

3,686,554

$

5,690,842

$

7,570,339

$

9,810,515

Percentage of direct

deposit active accounts

(5)

11.1

%

13.9

%

22.9

%

27.6

%

34.2

%