NetSpend 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

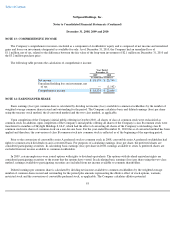

NOTE 16: COMMITMENTS AND CONTINGENCIES (Continued)

intended to cover the risk that it may not recover cardholders' overdrawn account balances were $1.6 million and $4.8 million, respectively. As

of December 31, 2009 and 2010, cardholders' overdrawn account balances totaled $4.1 million and $6.9 million, respectively.

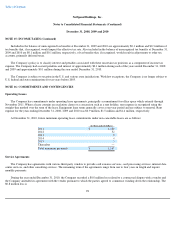

Alexsam Litigation

On October 24, 2007, Alexsam, Inc. filed suit against the Company in the District Court of Travis County, Texas, 419th Judicial District,

asserting breach of a license agreement entered into between the Company and Alexsam in 2004 and seeking monetary damages, attorneys'

fees, costs and interest. The license agreement was entered into by the parties following Alexsam's assertion and subsequent dismissal without

prejudice of a claim of patent infringement filed by Alexsam against us in 2003. The Company has asserted counterclaims against Alexsam for

breach of contract. In April 2010, the Company filed a motion for summary judgment, and following a hearing, the court denied the motion

without substantive comment. In October 2010, Alexsam filed an amended petition, which added a claim by Alexsam that NetSpend

fraudulently induced Alexsam to give up its prior patent infringement claims against NetSpend and enter into the license agreement. In

November 2010, the Company removed the case to the United States District Court for the Western District of Texas. On January 7, 2011, the

federal court remanded the case back to the Travis County District Court for the 419th Judicial District for further proceedings. The case is not

currently set for trial. The Company plans to vigorously contest Alexsam's claims, including Alexsam's newly asserted claims.

MPower Litigation

In 2008, the Company filed a lawsuit against MPower Ventures, LP, MPower Labs, Inc., Mango Financial, Inc., MPower Ventures

Management, LLC, Rogelio Sosa, Bertrand Sosa, Richard Child, and John Mitchell, and subsequently amended the suit to add Futeh Kao and

Mattrix Group, L.L.C (collectively, "defendants"). In this lawsuit, the Company alleged breach of fiduciary duties, breach of contractual and

common-law duties of confidentiality, breach of contractual non-solicitation, misappropriation of the Company's trade secrets and confidential

and proprietary information belonging to the Company, breach of noncompetition agreements, and engagement in a civil conspiracy. Defendant

Mitchell asserted counterclaims against the Company alleging breach of contract relating to consulting services and payment of certain

dividends, as well as for defamation. Mitchell sought actual and consequential damages and attorneys' fees.

In 2009, the Company reached agreements with the defendants, settling all disputes and claims between the Company and the defendants.

In connection with the settlement, the Company acquired 570,000 shares of its outstanding common stock held by certain of the defendants.

The settlement transactions resulted in the Company's non-cash acquisition of 400,000 shares of common stock, which is recorded as a

litigation settlement gain of $1.2 million in the Company's Consolidated Statement of Operations, and a $0.6 million cash payment to Richard

Child, which included the repurchase of 170,000 shares of common stock for $0.2 million.

Katz Settlement

In 2008, the Company received a letter from Ronald A. Katz Technology Licensing, L.P. ("RAKTL"), which contained an offer for the

Company to acquire a license under the RAKTL

100