NetSpend 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

agreement with a large national bank that we terminated effective 2009, as well as interest earned, if any, on cardholder funds maintained at

one of our issuing banks. Under our current arrangement with such issuing bank, we would only be entitled to receive interest on cardholder

funds if market interest rates rose significantly above current levels.

We earn interchange revenues from a portion of the interchange fees remitted by merchants when cardholders make purchase transactions

using our prepaid debit cards. Interchange revenues are fixed by the card associations and network organizations. Interchange revenues are

recognized net of sponsorship, licensing and processing fees charged by the card associations and network organizations for services they

provide in processing purchase transactions routed through their networks.

Our quarterly operating revenues fluctuate as a result of certain seasonal factors affecting our GDV and the number of our active cards.

For example, the most significant increases in the number of our active cards and our GDV typically occur in the first fiscal quarter as a result

of consumers acquiring new cards and loading federal tax refunds onto their cards during tax season.

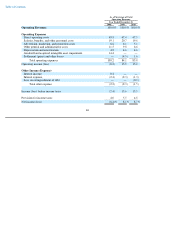

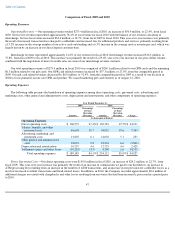

Operating Expenses

We classify our operating expenses into the following categories:

Direct Operating Costs —Direct operating costs consist primarily of the commissions we pay to members of our distribution and reload

network for their services, ATM processing fees, card supply costs, cardholder and other losses related to our card programs, customer

verification costs, customer service costs and fees paid to our issuing banks. These costs are driven by transaction volumes and the number of

active cards.

Salaries, Benefits and Other Personnel Costs —Salaries, benefits, and other personnel costs consist of the compensation costs associated

with our employees, including base salaries, benefits, bonus compensation and stock-based compensation. This excludes any personnel costs

associated with customer service, which are included in direct operating costs.

Advertising, Marketing and Promotion Costs —Advertising, marketing, and promotion costs primarily consist of the costs of marketing

programs including direct-to-consumer and internet advertising to potential cardholders, promotional events run in conjunction with our

distributors, conferences, trade shows and marketing materials.

Other General and Administrative Costs —Other general and administrative costs primarily consist of costs for legal, accounting,

information technology, travel, facility and other corporate expenses.

Depreciation and Amortization —Depreciation and amortization consists of depreciation of our long-lived assets and amortization of

finite-lived intangibles.

Other Income (Expense)

Other income (expense) primarily consists of interest income and interest expense. Interest income represents interest we receive on our

cash and cash equivalents. Interest expense is associated with our long-term debt and capital leases.

Income Tax Expense

Income tax expense primarily consists of corporate income taxes related to profits resulting from our ongoing operations.

44