NetSpend 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

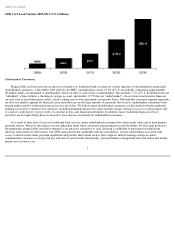

GPR Card Load Volumes 2009-2013 (U.S. $ billions)

Underbanked Consumers

Prepaid debit cards have proven an attractive alternative to traditional bank accounts for certain segments of the population, particularly

underbanked consumers. A December 2009 study by the FDIC concluded that at least 25.6% of U.S. households, comprising approximately

60 million adults, are unbanked or underbanked, which we refer to collectively as underbanked. This includes 7.7% of U.S. households that are

"unbanked"—those without a checking or savings account, and another 17.9% that are "underbanked"—those reliant on alternative financial

services such as non-bank money orders, check cashing, rent-to-

own agreements and payday loans. Although this consumer segment represents

an attractive market segment for financial services products given the large amounts of payments they receive, underbanked consumers often

remain underserved by traditional financial services providers. We believe many underbanked consumers are dissatisfied with the traditional

banking sector due to expensive fee structures, including minimum balance fees and overdraft charges, denial of access to credit products due

to a lack of credit history or poor credit, or a distrust in non-cash financial instruments. In addition, many traditional financial services

providers are not open during hours or located in areas that are convenient for underbanked consumers.

As a result of their lack of access to traditional bank services, many underbanked consumers have historically used cash as their primary

payment vehicle. However, the reliance on cash inherently limits these consumers' purchasing power and flexibility. For this large portion of

the population, prepaid debit cards have emerged as an attractive alternative to cash, allowing a cardholder to participate in mainstream

financial transactions by other means. Our GPR cards provide the cardholder with the convenience, security and freedom associated with

access to universal electronic payment capabilities and product innovations such as direct deposit, interest-bearing savings accounts,

complimentary insurance coverage, bill pay and card-to-card transfer functionality, personal finance management tools and online and mobile

phone card account access.

3