NetSpend 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

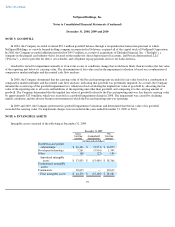

NOTE 6: INTANGIBLE ASSETS (Continued)

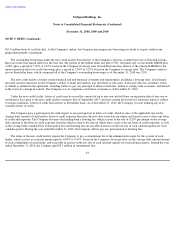

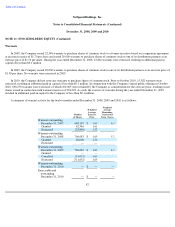

Intangible assets consisted of the following at December 31, 2010:

As part of the Company's acquisition of Skylight in 2008, the Company acquired the "Skylight" trade name. Based on the reputation of the

Skylight tradename and the anticipated future benefits and cash flows the tradename is expected to contribute, the Company accounts for the

tradename as an indefinite lived intangible asset.

As part of the Company's annual impairment test, the Company considers whether factors have changed and whether the tradename

should be subject to amortization. In 2008, the Company incurred an impairment charge of approximately $3.3 million reflecting the

impairment of the Skylight tradename as the carrying amount of the tradename exceeded its fair value. The impairment was due to declining

market conditions and the adverse business environment in which the Paycard reporting unit was operating. As of December 31, 2010, the

Skylight tradename continues to have an indefinite life as the Company continues to use the Skylight tradename on certain of its products.

In 2009 and 2010 the Company performed its intangible asset impairment evaluations and determined that the fair value of the intangible

assets exceeded their carrying values. No impairment charges were recorded in the years ended December 31, 2009 or 2010.

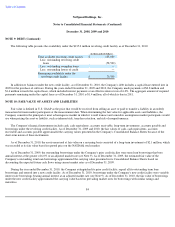

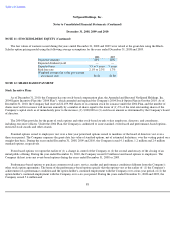

Amortization expense for the years ended December 31, 2008, 2009 and 2010 was $3.2 million, $3.5 million, and $3.2 million,

respectively. At December 31, 2010, estimated amortization expense for the next five years and thereafter is as follows:

80

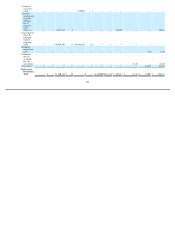

December 31, 2010

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Amount

(in thousands of dollars)

Distributor and partner

relationships

$

26,426

$

(12,449

)

$

13,977

Developed technology

7,261

(6,251

)

1,010

Other

172

(35

)

137

Amortized intangible

assets

$

33,859

$

(18,735

)

$

15,124

Unamortized intangible

assets:

Tradenames

10,615

—

10,615

Total intangible assets

$

44,474

$

(18,735

)

$

25,739

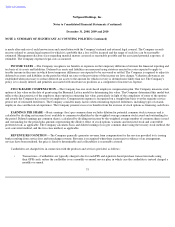

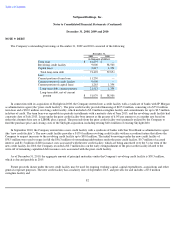

(in thousands of dollars)

2011

$

3,524

2012

2,272

2013

1,714

2014

1,714

2015

1,684

Thereafter

4,216

$

15,124