NetSpend 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

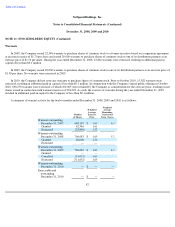

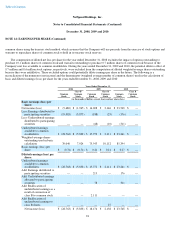

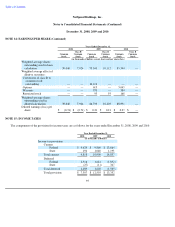

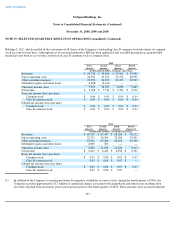

NOTE 14: EARNINGS PER SHARE (Continued)

common shares using the treasury stock method, which assumes that the Company will use proceeds from the exercise of stock options and

warrants to repurchase shares of common stock to hold in its treasury stock reserves.

The computation of diluted net loss per share for the year ended December 31, 2008 excludes the impact of options outstanding to

purchase 10.1 million shares of common stock and warrants outstanding to purchase 0.7 million shares of common stock because of the

Company's net loss available to common stockholders. During the years ended December 31, 2009 and 2010, the potential dilutive effect of

9.7 million and 0.6 million stock options, respectively, were excluded from the computation of diluted weighted average shares outstanding

because they were antidilutive. These excluded options could potentially dilute earnings per share in the future. The following is a

reconciliation of the numerator (net income) and the denominator (weighted average number of common shares) used in the calculation of

basic and diluted earnings (loss) per share for the years ended December 31, 2008, 2009 and 2010:

94

Years Ended December 31,

2008 2009 2010

Common

Stock

Class B

Common

Stock Common

Stock

Class B

Common

Stock Common

Stock

Class B

Common

Stock

(in thousands of dollars, except share and per share data)

Basic earnings (loss) per

share:

Net income (loss)

$

(9,680

)

$

(1,965

)

$

16,028

$

2,146

$

23,748

$

—

Less: Earnings distributed to

participating securities

(19,083

)

(3,873

)

(188

)

(25

)

(176

)

—

Less: Undistributed earnings

distributed to participating

securities

—

—

(

68

)

(10

)

(311

)

—

Undistributed earnings

available to common

stockholders

$

(28,763

)

$

(5,838

)

$

15,772

$

2,111

$

23,261

$

—

Weighted-average shares

outstanding used in basic

calculation

39,040

7,924

75,543

10,112

85,394

—

Basic earnings (loss) per

share

$

(0.74

)

$

(0.74

)

$

0.21

$

0.21

$

0.27

$

—

Diluted earnings (loss) per

share:

Undistributed earnings

available to common

stockholders

$

(28,763

)

$

(5,838

)

$

15,772

$

2,111

$

23,261

$

—

Add: Earnings distributed to

participating securities

—

—

213

—

176

—

Add: Undistributed earnings

allocated to participating

securities

—

—

78

—

311

—

Add: Reallocation of

undistributed earnings as a

result of conversion of

class B to common stock

—

—

2,111

—

—

—

Add: Reallocation of

undistributed earnings to

class B shares

—

—

—

27

—

—

Net income (loss)

$

(28,763

)

$

(5,838

)

$

18,174

$

2,138

$

23,748

$

—