NetSpend 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

NOTE 12: SHARE BASED PAYMENT (Continued)

The remaining service period associated with a portion of CEO's performance-based options was shortened based on the Company's

achievement of performance targets related to the Company's equity valuation. As a result of the initial public offering, certain performance

based attributes were triggered in addition to the time based vesting conditions embedded in these awards. The Company accelerated

recognition of the unamortized stock option expense over the remaining estimated explicit service period.

During the year ended December 31, 2010, the Company recognized additional compensation expense of approximately $0.9 million

related to accelerated vesting associated with its initial public offering, of which $0.7 million related to the accelerated vesting of options and

$0.2 million related to the accelerated vesting of restricted stock.

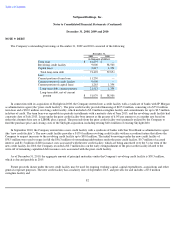

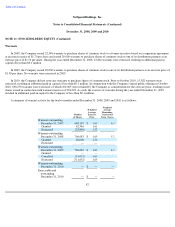

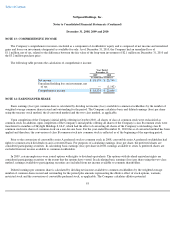

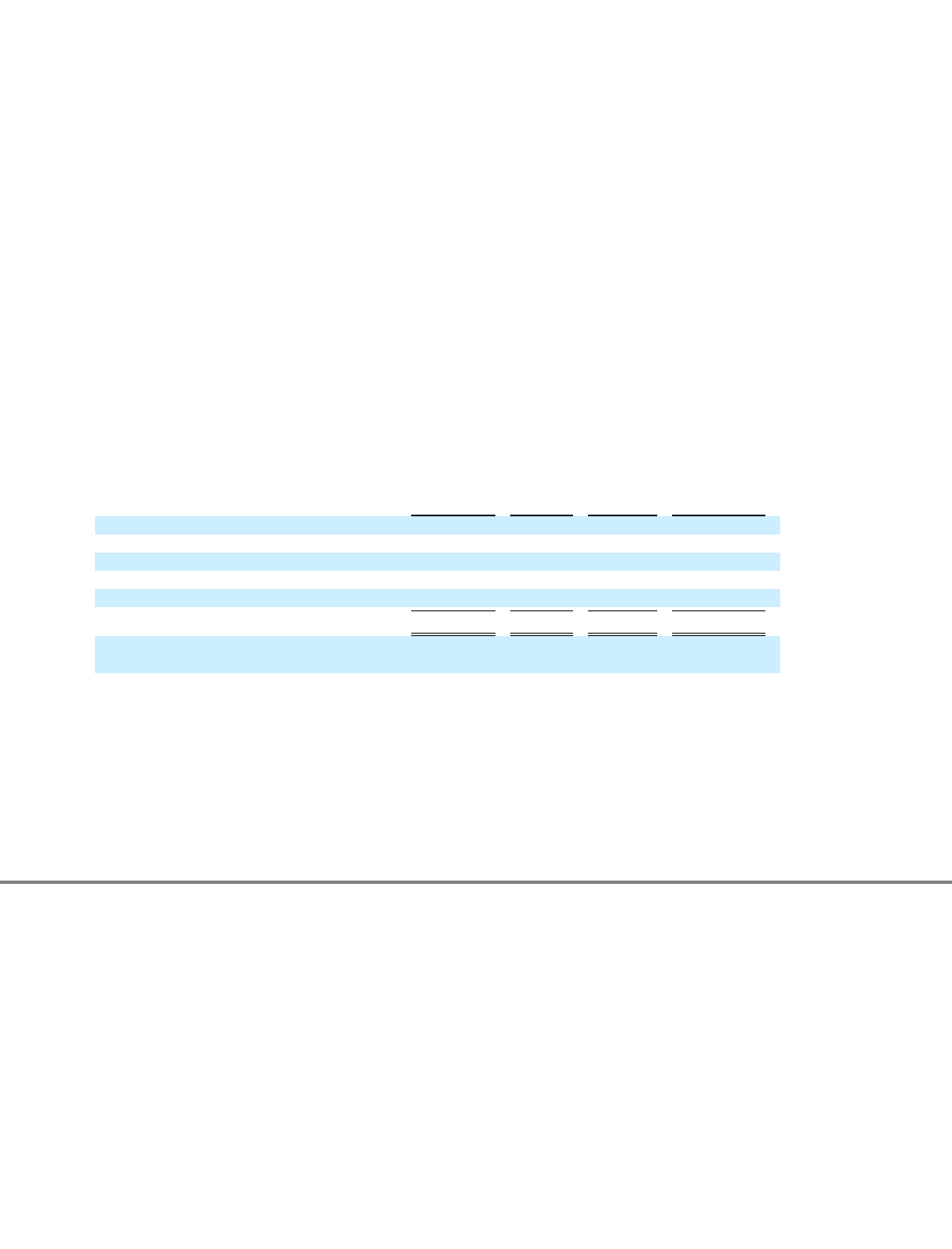

The following table presents a summary of stock option activity for the year ended December 31, 2010:

The aggregate intrinsic value in the table above represents the total pre-tax value, which is calculated as the difference between the

Company's stock price on December 31, 2010 and the exercise price, multiplied by the number of in-the-money options that would have been

received by the option holders had all option holders exercised their options on December 31, 2010. This amount changes based on the fair

value of the Company's stock. The intrinsic value of options exercised during 2008, 2009 and 2010 was $2.3 million, $0.1 million and

$9.2 million, respectively.

90

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

Outstanding December 31, 2009

9,716,961

$

3.26

Granted

3,244,574

5.22

Exercised

(1,239,724

)

2.81

Expired

(86,278

)

1.48

Forfeited

(599,927

)

3.54

Outstanding December 31, 2010

11,035,606

$

3.88

7.8 years

$

98,705,957

Vested and expected to vest at December 31,

2010

10,116,746

$

3.86

7.2 years

$

90,622,200

Exercisable at December 31, 2010

2,705,097

$

3.02

7.0 years

$

52,414,740