NetSpend 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

NOTE 15: INCOME TAXES (Continued)

Included in the balance of unrecognized tax benefits at December 31, 2009 and 2010 are approximately $0.1 million and $0.3 million of

tax benefits that, if recognized, would impact the effective tax rate. Also included in the balance of unrecognized tax benefits at December 31,

2009 and 2010 are $0.1 million and $0.1 million, respectively, of tax benefits that, if recognized, would result in adjustments to other tax

accounts, primarily deferred taxes.

The Company's policy is to classify interest and penalties associated with these uncertain tax positions as a component of income tax

expense. The Company had accrued penalties and interest of approximately $0.1 million during each of the years ended December 31, 2008

and 2009 and approximately $0.1 million during the year ended December 31, 2010.

The Company is subject to taxation in the U.S. and various state jurisdictions. With few exceptions, the Company is no longer subject to

U.S. federal and state examinations for tax years before 2005.

NOTE 16: COMMITMENTS AND CONTINGENCIES

Operating Leases

The Company has commitments under operating lease agreements, principally a commitment for office space which extends through

November 2011. Where a lease contains an escalation clause or a concession such as a rent holiday, rent expense is recognized using the

straight-line method over the term of the lease. Equipment lease terms generally cover a one-year period and are subject to renewal. Rent

expense for the years ending December 31, 2008, 2009 and 2010 was $0.9 million, $1.5 million and $1.4 million, respectively.

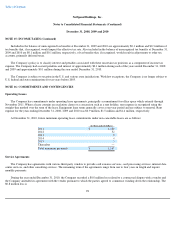

At December 31, 2010, future minimum operating lease commitments under non-cancelable leases are as follows:

Service Agreements

The Company has agreements with various third-party vendors to provide card issuance services, card processing services, internet data

center services, and other consulting services. The remaining term of the agreements range from one to four years in length and require

monthly payments.

During the year ended December 31, 2010, the Company recorded a $0.8 million loss related to a contractual dispute with a vendor and

the Company amended its agreement with the vendor pursuant to which the parties agreed to commence winding down the relationship. The

$0.8 million loss is

98

(in thousands of dollars)

2011

$

1,100

2012

52

2013

8

2014

4

2015

3

Thereafter

—

Total minimum payments

$

1,167