NetSpend 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NetSpend Holdings, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2008, 2009 and 2010

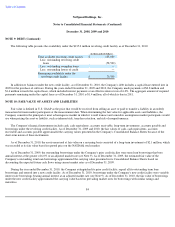

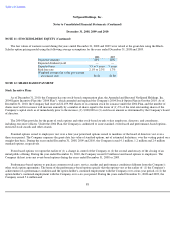

NOTE 9: DEBT

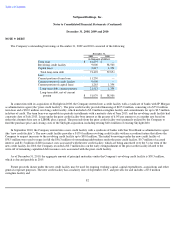

The Company's outstanding borrowings at December 31, 2009 and 2010 consisted of the following:

In connection with its acquisition of Skylight in 2008, the Company entered into a credit facility with a syndicate of banks with JP Morgan

as administrative agent (the "prior credit facility"). The prior credit facility provided financing of $105.0 million, consisting of a $75.0 million

term loan and a $30.0 million revolving credit facility, which included a $2.0 million swingline facility and commitments for up to $2.5 million

in letters of credit. The term loan was repayable in quarterly installments with a maturity date of June 2013, and the revolving credit facility had

a maturity date of July 2013. Loans under the prior credit facility bore interest at the greater of 6.0% per annum or at a market rate based on

either the alternate base rate or LIBOR, plus a spread. The proceeds from the prior credit facility were primarily utilized by the Company to

fund the purchase price and closing costs of the Skylight acquisition, including retiring $40.4 million of existing Skylight debt.

In September 2010, the Company entered into a new credit facility with a syndicate of banks with Sun Trust Bank as administrative agent

(the "new credit facility"). The new credit facility provides a $135.0 million revolving credit facility with an accordion feature that allows the

Company to request increases to the revolving credit facility up to $50.0 million. The initial borrowings under the new credit facility of

$58.5 million were used to repay in full the $56.3 million of outstanding indebtedness under the prior credit facility, $0.7 million of accrued

interest, and $1.5 million of debt issuance costs associated with the new credit facility, which are being amortized over the 5-year term of the

new credit facility. In 2010, the Company recorded a $0.7 million loss on the early extinguishment of the prior credit facility related to the

write-off of remaining capitalized debt issuance costs associated with the prior credit facility.

As of December 31, 2010, the aggregate amount of principal maturities under the Company's revolving credit facility is $58.5 million,

which is due and payable in 2015.

Future proceeds drawn under the new credit facility may be used for ongoing working capital, capital expenditures, acquisitions and other

general corporate purposes. The new credit facility has a maturity date of September 2015, and provides for and includes a $5.0 million

swingline facility and

82

December 31,

2009 2010

(in thousands of dollars)

Term loan

$

61,875

$

—

Revolving credit facility

9,000

58,500

Capital lease

2,617

1,354

Total long

-

term debt

73,492

59,854

Less:

Current portion of term loan

11,250

—

Current portion of credit facility

9,000

—

Current portion of capital lease

1,263

1,354

Long

-

term debt, current portion

21,513

1,354

Long-term debt, net of current

portion

$

51,979

$

58,500