NetSpend 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Our cardholders can in some circumstances incur charges in excess of the funds available in their card accounts, and are liable for the

resulting overdrawn account balance. While we generally decline authorization attempts for amounts that exceed the available balance in a

cardholder's account, the application of card association and network organization rules and regulations, the timing of the settlement of

transactions and the assessment of subscription, maintenance or other fees, among other things, can result in overdrawn card accounts. We also

provide, as a courtesy and at our discretion, certain cardholders with a "cushion" which allows them to overdraw their card accounts. In

addition, eligible cardholders may enroll in our issuing banks' overdraft protection programs pursuant to which our issuing banks fund

transactions up to $1.0 million that exceed the available balance in their card accounts. We are responsible to our issuing banks for any losses

associated with these overdrawn account balances. As of December 31, 2010, our reserve intended to cover the risk that we may not recover

our cardholders' overdrawn account balances was approximately $4.8 million. As of December 31, 2010, our cardholders' overdrawn account

balances totaled $6.9 million.

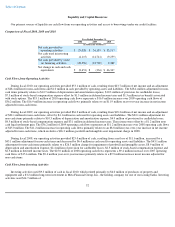

Contractual Obligations and Commitments

During the year ended December 31, 2010 we entered into a new credit facility with a syndicate of banks with SunTrust Bank as

administrative agent. The initial borrowings under this new credit facility of $58.5 million were used to repay in full the $56.3 million

outstanding indebtedness under our prior credit facility and $1.5 million of debt issuance costs associated with the new credit facility. See

"Note 9—Debt" to the consolidated financial statements included in this Form 10-K for a discussion of the terms of our new credit facility.

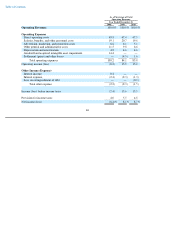

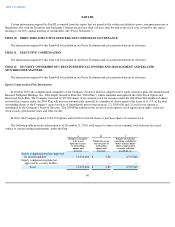

Our contractual commitments and contingencies will have an impact on our future liquidity. The following table summarizes our

contractual obligations that represent material expected or contractually committed future obligations as of December 31, 2010:

55

Payments Due by Period

As Of December 31, 2010

Total Less than

1 Year 1-3 Years 3-5 Years More than

5 Years

(in thousands of dollars)

Long

-

term debt obligations(1)

$

66,836

$

1,755

$

3,510

$

61,571

$

—

Capital lease obligations(2)

1,401

1,401

—

—

—

Operating lease obligations(3)

1,167

1,100

60

7

—

Other long

-

term liabilities(4)

33,580

11,039

17,023

5,518

—

Total

$

102,984

$

15,295

$

20,593

$

67,096

$

—

(1) Long-term debt obligations consisted of outstanding principal and expected interest payments under our credit facility as

of December 31, 2010. These future expected payments include $58.5 million in repayment of principal that is expected

to be repaid upon maturity in September 2015 and $8.3 million in future interest payments applicable to the outstanding

borrowings at an expected interest rate of 3.0% per year through September 2015.

(2) Capitalized lease obligations consist of future required payments under our financing agreement to purchase software.

(3)

Operating lease obligations primarily include future payments related to the lease for our primary office facility located in

Austin, Texas. The Austin, Texas lease expires in 2011.

(4) Other long-term obligations consist of required minimum future payments under contracts with our distributors and other

service providers.