NetSpend 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

cash in fiscal 2009, which related primarily to $14.6 million of purchases of property and equipment. Cash used for investing activities in fiscal

2008 was $4.1 million, which included $10.7 million of purchases of property and equipment offset by $6.6 million of net cash acquired

primarily from our acquisition of Skylight.

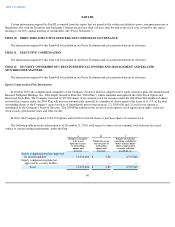

Cash Flows from Financing Activities

Financing activities provided for $2.5 million of cash in fiscal 2010, primarily related to $21.0 million in proceeds, net of offering costs,

from our initial public offering in October 2010, a $1.5 million income tax benefit associated with stock options and $0.9 million of cash from

the exercise of common stock options and warrants. These proceeds were partially offset by $6.5 million in scheduled debt payments and a

$9.0 million revolving debt payment. In September 2010 we entered into a new credit facility with a syndicate of banks with SunTrust Bank as

administrative agent. The initial borrowings under this new credit facility of $58.5 million were used to repay in full the remaining

$56.3 million outstanding indebtedness under our prior credit facility, $0.7 million of accrued interest, and $1.5 million of debt issuance costs

associated with the new credit facility. The remainder of the cash used in financing activities for fiscal 2010 was comprised of a $5.7 million

repurchase of treasury stock.

Financing activities used $21.8 million of cash in fiscal 2009. The $21.8 million of cash outflows primarily related to $25.5 million in

debt-related payments, which included $25.1 million of principal payments and $0.4 million of debt issuance costs. The $25.5 million of debt-

related payments was partially offset by a $9.0 million draw on the revolving credit facility during 2009. Financing cash flows in 2009 also

included a $5.0 million cash outflow related to the remaining portion of a $30.0 million dividend declared in 2008.

Financing activities used $29.6 million of cash in fiscal 2008. The $29.6 million of cash outflows primarily related to $25.0 million of

dividend payments related to a $30.0 million dividend declared immediately prior to the Skylight acquisition. The remaining $5.0 million of

this dividend was paid in fiscal 2009. Also in conjunction with the Skylight acquisition, we entered into an amended and restated credit

agreement, which resulted in the payment of $91.5 million towards the outstanding balance on the old term loans and line of credit and

$1.2 million of debt issuance costs related to the amended and restated credit agreement. Simultaneous with the payment of the balance on the

old term loans and line of credit, we borrowed $75.0 million on the new term loan and $10.0 million on the new line of credit. We subsequently

drew an additional $5.0 million on the line of credit during fiscal 2008 to fund working capital requirements. These repayments and borrowings

resulted in a net cash outflow of $2.7 million in 2008. Also included in cash flows from financing activities during 2008 was a $3.2 million

purchase of treasury stock associated with the former chief executive officer's separation agreement, which was partially offset by $1.3 million

of proceeds from the exercise of common stock options and warrants.

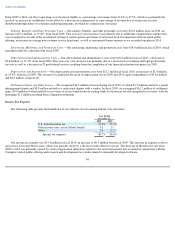

Sources of Financing

Since the inception of NetSpend Holdings in February 2004, we have primarily financed our operations through cash flows from

operations, debt financing and net proceeds received from our initial public offering in October 2010. We believe that our existing cash

balances, together with the amounts we expect to generate from operations and the amounts available through our revolving credit facility will

be sufficient to meet our operating needs for the next twelve months, including working capital requirements, capital expenditures and debt

repayment obligations.

In connection with the acquisition of Skylight on July 15, 2008, we entered into a credit agreement (the "prior credit facility"), which

provided financing of $105.0 million, consisting of a $30.0 million revolving credit facility and a $75.0 million term loan. We utilized the

proceeds of the $75.0 million

53