NetSpend 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETSPEND HOLDINGS, INC.

FORM 10-K

(Annual Report)

Filed 03/02/11 for the Period Ending 12/31/10

Address 701 BRAZOS STREET

SUITE 1300

AUSTIN, TX 78701-2582

Telephone (512) 532-8200

CIK 0001496623

Symbol NTSP

SIC Code 6199 - Finance Services

Industry Consumer Financial Services

Sector Financial

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2011, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

NETSPEND HOLDINGS, INC. FORM 10-K (Annual Report) Filed 03/02/11 for the Period Ending 12/31/10 Address 701 BRAZOS STREET SUITE 1300 AUSTIN, TX 78701-2582 (512) 532-8200 0001496623 NTSP 6199 - Finance Services Consumer Financial Services Financial 12/31 Telephone CIK Symbol SIC Code Industry ... -

Page 2

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 Commission file number: 001-34915 NetSpend Holdings, Inc. (Exact name of registrant as ... -

Page 3

... was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore cannot calculate the aggregate market value of its common equity held by non-affiliates as of such date. The number of shares of the registrant's common stock outstanding on... -

Page 4

... Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services PART IV Exhibits, Financial... -

Page 5

...differ materially from the expectations we describe in our forward-looking statements. You should carefully review the risks described herein and in other documents we file from time to time with the Securities and Exchange Commission, including Quarterly Reports on Form 10-Q to be filed in 2011. We... -

Page 6

...MasterCard, Visa or PULSE networks and to withdraw funds at participating automated teller machines, or ATMs. The additional features we offer to our cardholders include direct deposit, interest-bearing savings accounts, bill pay and card-to-card transfer functionality, personal financial management... -

Page 7

...security and freedom associated with access to universal electronic payment capabilities and product innovations such as direct deposit, interest-bearing savings accounts, complimentary insurance coverage, bill pay and card-to-card transfer functionality, personal finance management tools and online... -

Page 8

... substantial public company experience in financial services, payment systems, retail program management, direct marketing and technology. We believe that the strength and experience of our management team has helped us attract and retain our cardholders and distributors and create a differentiated... -

Page 9

... card to be "active" if a personal identification number, or PIN, or signature-based purchase transaction, a load transaction at a retailer location, or an ATM withdrawal has been made with respect to such card within the previous 90 days. Marketed and processed by us and issued by our issuing banks... -

Page 10

... in the MasterCard, Visa or PULSE network and withdraw funds at participating ATMs. Funds may be loaded onto the GPR cards we market through our retail distributors and our direct-to-consumer and online marketing programs by a cardholder reloading his or her GPR card at a retail location within our... -

Page 11

... 2010, we offered reload services through approximately 500 retailers at over 100,000 locations in the U.S. Our reload network is designed to provide convenient ways for our cardholders to add more funds to their cards, to provide our retail distributors with additional opportunities to earn revenue... -

Page 12

.... Program Management Customer Acquisition and Account Activation. Customers that acquire cards through our retail distributors and corporate employers are typically issued a temporary "Instant Issue" card with funds immediately available at reduced load and transaction limits. Card applications are... -

Page 13

... depository accounts. Members of our distribution and reload network collect our cardholders' funds and remit them by electronic transfer to our issuing banks for deposit in the card accounts. Loads made through direct deposit are routed from the originating depository financial institutions... -

Page 14

... existing cardholder and direct deposit relationships and other operational considerations. In furtherance of this strategy, in January 2011 we entered into an agreement with The Bancorp Bank, pursuant to which The Bancorp Bank will serve as a new issuing bank for our new and existing card programs... -

Page 15

...Pay-O-Matic, Inc. and Checksmart Financial Company began to distribute their own GPR cards through their stores. While the increased desire of banks, retailers and alternative financial services providers to develop successful prepaid debit card programs frequently creates new business opportunities... -

Page 16

..., 2010, the FRB issued a final rule implementing Title IV of the Credit Card Accountability, Responsibility, and Disclosure Act of 2009, or CARD Act, which imposes requirements relating to disclosures, fees and expiration dates that are generally applicable to gift certificates, store gift cards and... -

Page 17

... all consumer funds related to the sale or load of our prepaid debit cards and remit them by electronic transfer directly to our issuing banks. We, in turn, are compensated directly by each issuing bank for our provision of program management and processing services related to our prepaid cards. We... -

Page 18

...our card programs for purposes of money laundering or terrorist financing, could have a material adverse impact on our business." Privacy and Data Security Laws and Regulations We collect and store personally identifiable information about our cardholders, including names, addresses, social security... -

Page 19

...transactions routed through these networks. We continue to work with our issuing banks to implement and maintain appropriate policies and programs as well as adapt our business practices in order to comply with all applicable rules and standards. Other Laws and Regulations As we develop new services... -

Page 20

... financial services is highly competitive. We directly compete with a number of companies that market and serve as program managers for open-loop prepaid debit cards through retail and online distribution, such as Green Dot Corporation, AccountNow, Inc. and Blackhawk Network Inc. Open-loop prepaid... -

Page 21

... adverse effect on our business, financial condition and operating results. The success of our business depends substantially on our ability to attract and retain retailers with a large number of locations that are convenient for our cardholders to purchase and reload our GPR cards. In the future... -

Page 22

..., 2010, the FRB issued a final rule implementing Title IV of the Credit Card Accountability, Responsibility, and Disclosure Act of 2009, or CARD Act, which imposes requirements relating to disclosures, fees and expiration dates that are generally applicable to gift certificates, store gift cards and... -

Page 23

...their locations, which in turn could have an adverse impact on our business. As each of our retail distributors offering prepaid cards and related services conducts such activity either as an agent of our issuing banks or, where applicable, of NetSpend in its capacity as a licensed money transmitter... -

Page 24

... could decrease our revenues and negatively impact our business and financial performance. A material portion of our operating revenues is derived from our share of the fees charged to merchants for services provided in settling transactions routed through the networks of the card associations and... -

Page 25

...services could negatively impact our financial position by increasing our costs and reducing our revenue. Furthermore, states may adopt statutes which could limit the application of certain fees or otherwise increase the costs incurred, or negatively impact the revenue received, by our issuing banks... -

Page 26

... change the rule in light of the comments it receives during the public comment period in a manner that would limit or prohibit the electronic deposit of federal benefits, wages and tax refunds onto our GPR cards, which would result in a material adverse impact on our revenues. Our card programs are... -

Page 27

...ATM networks, membership in the card associations and network organizations and other banking services. As of December 31, 2010, approximately 74% of our active cards were issued through MetaBank. MetaBank is our preferred issuing bank and has designated us as a preferred program manager for prepaid... -

Page 28

...collect and store personally identifiable information about our cardholders, including names, addresses, social security numbers, driver's license numbers and account numbers, and maintain a database of cardholder data relating to specific transactions, including account numbers, in order to process... -

Page 29

...the payments industry are protected by a wide array of patents and other intellectual property rights. As a result, third parties may assert infringement and misappropriation claims against us from time to time based on our general business operations or the equipment, software or services we use or... -

Page 30

... by our issuing banks, card accounts may become overdrawn through the application of card association and network organization rules and regulations, the timing of the settlement of card transactions and the assessment of subscription, maintenance or other fees charged by our issuing banks. We also... -

Page 31

... load and reload services to our cardholders at their retail locations. Members of our distribution and reload network collect our cardholders' funds and are contractually required to remit them by electronic transfer directly to our issuing banks for deposit in the cardholder accounts. Our issuing... -

Page 32

... features such as direct deposit loading onto reloadable prepaid debit cards have increased the attractiveness of such cards and increased their utility to underbanked consumers. Because direct deposit active cardholders on average initiate more debit transactions and generate more revenues for us... -

Page 33

... agreements and arrangements with our employees, affiliates, business partners and customers to establish and protect our intellectual property and similar proprietary rights. We have one patent registered and four patent applications pending with the United States Patent and Trademark Office... -

Page 34

... and limit our flexibility in obtaining additional financing and in pursuing other business opportunities. In September 2010, we entered into a new revolving credit agreement with a syndicate of banks with SunTrust Bank as administrative agent. This new credit agreement provides a revolving credit... -

Page 35

... of Section 404 of the Sarbanes-Oxley Act and related rules and regulations of the SEC and the Public Company Accounting Oversight Board. The adequacy of our internal control over financial reporting must be assessed by management each year commencing with the year ending December 31, 2011... -

Page 36

Table of Contents Risks Related to Ownership of Our Common Stock We have a limited trading history, and our stock price may be volatile. Prior to the consummation of our initial public offering in October 2010, our common stock was not listed on a national exchange or publicly traded. As an issuer ... -

Page 37

... or potential acquirers to acquire us without negotiation. These provisions may apply even if some stockholders may consider the transaction beneficial to them. These provisions could limit the price that investors are willing to pay in the future for shares of our common stock. These provisions... -

Page 38

... or financial condition. On October 24, 2007, Alexsam, Inc. filed suit against us in the District Court of Travis County, Texas, 419th Judicial District, asserting breach of a license agreement entered into between NetSpend and Alexsam in 2004 and seeking monetary damages, attorneys' fees, costs and... -

Page 39

... by our board of directors. In addition, the terms of our credit facility currently restricts our ability to pay dividends. Unregistered Sales of Equity Securities For the twelve months ended December 31, 2010, we issued and sold 1,000,215 shares of common stock to certain of our employees and... -

Page 40

...the proceeds from the sale of shares by the selling stockholders. The proceeds from the initial public offering were allocated to cash and cash equivalents to fund working capital. There have been no material changes in our planned use of proceeds from the initial public offering as described in our... -

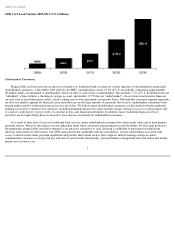

Page 41

... per share data) 2006 2010 Revenues Direct operating costs Other operating expenses Goodwill and intangible asset impairment Settlement (gains) and other losses Operating income (loss) Income (loss) before income taxes Income tax expense Net income Net income (loss) per share: Basic Common stock... -

Page 42

...Contents Other Financial and Operating Data Year Ended December 31, 2008 (dollars in thousands) (unaudited) 2006 2007 2009 2010 Adjusted EBITDA(1) Adjusted net income(2) Number of active cards (at period end)(3) Gross dollar volume(4) Percentage of direct deposit active accounts (5) $ $ 5,200... -

Page 43

...active cards represents the total number of our GPR card accounts that have had a PIN or signature-based transaction, a load transaction at a retailer location or an ATM withdrawal within the previous 90 days. Gross dollar volume represents the total volume of debit transactions and cash withdrawals... -

Page 44

... income, cash flows from operating activities or other financial information as determined by U.S. GAAP. Our presentation of Adjusted Net Income should not be construed as an implication that our future results will be unaffected by unusual or non-recurring items. (1) The 2008 tax rate was adjusted... -

Page 45

...GPR cards. Our cardholders may use their GPR cards to make purchase transactions at any merchant that participates in the MasterCard, Visa or PULSE networks and to withdraw funds from participating ATMs. MetaBank holds the majority of our cardholders funds. In January 2010, we acquired approximately... -

Page 46

... when cardholders make purchase transactions using our prepaid debit cards. Interchange revenues are recognized net of sponsorship, licensing and processing fees charged by the card associations and network organizations for services they provide in processing purchase transactions routed through... -

Page 47

... our GPR cards, including overdraft protection through our issuing banks, a variety of bill payment options, custom card designs, and card-to-card transfers of funds through our customer service. Other-Cardholders are charged fees in connection with the activation of our GPR cards and gift cards at... -

Page 48

...we pay to members of our distribution and reload network for their services, ATM processing fees, card supply costs, cardholder and other losses related to our card programs, customer verification costs, customer service costs and fees paid to our issuing banks. These costs are driven by transaction... -

Page 49

... 31, 2009 2010 (in thousands of dollars) 2008 Operating Revenues Operating Expenses Direct operating costs Salaries, benefits, and other personnel costs Advertising, marketing, and promotion costs Other general and administrative costs Depreciation and amortization Goodwill and acquired intangible... -

Page 50

...31, 2008 2009 2010 Operating Revenues Operating Expenses Direct operating costs Salaries, benefits, and other personnel costs Advertising, marketing, and promotion costs Other general and administrative costs Depreciation and amortization Goodwill and acquired intangible asset impairment Settlement... -

Page 51

... to cardholders and increased fees for additional products and services, primarily resulting from a 15.2% increase in the average number of our active cards outstanding and a 6.3% increase in the average service revenue per card, which was largely driven by an increase in our direct deposit customer... -

Page 52

... tax rate. The decrease in the effective rate from 2009 to 2010 was primarily caused by stock compensation deductions related to the stock transactions that occurred in conjunction with the Company's initial public offering and research and development tax credits related to internally developed... -

Page 53

... increase in the average number of our active cards outstanding. $6.7 million of the increase in transaction fees was caused by rate changes in the fees charged for domestic ATM transactions. These increases were offset by a decrease in customer service and maintenance fees unrelated to the Skylight... -

Page 54

... of an increase in card supply costs as a percentage of revenues as we expanded our direct-toconsumer marketing programs, and an increase in distributor commission rates as we renewed long-term distributor agreements. Salaries, Benefits, and Other Personnel Costs -Our salaries, benefits, and other... -

Page 55

... to recoveries of excess funds from our issuing banks for historical fee and chargeback recoveries, with the remaining $1.2 million resulting from a litigation settlement. Income Tax Expense The following table presents the breakdown of our effective tax rate among federal, state and other: Year... -

Page 56

... Activities Investing activities used $9.3 million of cash in fiscal 2010, which related primarily to $6.0 million of purchases of property and equipment and a $3.2 million long-term investment in Meta Financial Group, Inc., the holding company for one of our issuing banks. Investing activities used... -

Page 57

... of offering costs, from our initial public offering in October 2010, a $1.5 million income tax benefit associated with stock options and $0.9 million of cash from the exercise of common stock options and warrants. These proceeds were partially offset by $6.5 million in scheduled debt payments and... -

Page 58

... our business is conducted through our retail distributors that provide load and reload services to our cardholders at their retail locations. Members of our distribution and reload network collect our cardholders' funds and remit them by electronic transfer directly to our issuing banks for deposit... -

Page 59

... their card accounts. In addition, eligible cardholders may enroll in our issuing banks' overdraft protection programs pursuant to which our issuing banks fund transactions up to $1.0 million that exceed the available balance in their card accounts. We are responsible to our issuing banks for... -

Page 60

... protection through our issuing banks, a variety of bill payment options, custom card designs and card-to-card transfers of funds through our customer service. Other-Cardholders are charged fees in connection with the activation of our GPR cards and gift cards at retailers. • • • Revenue... -

Page 61

... reload of our GPR cards is recognized when the fee is charged. Our revenues also include fees charged in connection with program management and processing services we provide for private-label programs, as well as fees charged to one of our issuing banks based on interest earned on cardholder funds... -

Page 62

... used derivative financial instruments to manage these market risks. As of December 31, 2010, outstanding borrowings under our credit facility were $58.5 million. A 1.0% increase or decrease in interest rates would have a $0.6 million impact on our operating results and cash flows for fiscal 2010... -

Page 63

... of the Sarbanes-Oxley Act, adopted rules requiring every company that files reports with the SEC to include a management report on such company's internal control over financial reporting in its annual report. In addition, our independent registered public accounting firm may be required to attest... -

Page 64

... 14A with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year covered by this report relating to our 2011 annual meeting of stockholders (the "Proxy Statement"). ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE The information required by... -

Page 65

... ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE The information required by this Item will be included in our Proxy Statement and is incorporated herein by reference. ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES The information required by this Item will be... -

Page 66

... by reference herein) 10.2 Pledge and Security Agreement, dated as of September 24, 2010, by and among NetSpend Holdings, Inc., NetSpend Corporation, Skylight Acquisition I, Inc., Skylight Financial, Inc., NetSpend Payment Services and SunTrust Bank, as Administrative Agent (filed as Exhibit 10.2 to... -

Page 67

... (Reg. No. 333-168127) on September 28, 2010, and incorporated by reference herein) 10.14 Office Lease, dated as of August 11, 2003, by and between Crescent Real Estate Funding VIII, L.P. and NetSpend Corporation (filed as Exhibit 10.14 to NetSpend Holdings, Inc.'s Form S-1/A (Reg. No. 333-168127... -

Page 68

...No. 333-168127) on September 17, 2010, and incorporated by reference herein) 10.21 Card Program Management Agreement, dated as of February 1, 2010, by and between MetaBank, dba Meta Payment Systems, and Skylight Financial, Inc. (filed as Exhibit 10.21 to NetSpend Holdings, Inc.'s Form S-1/A (Reg. No... -

Page 69

.... Stock Option Award Agreement (PerformanceBased Vesting) filed as Exhibit 10.31 to NetSpend Holdings, Inc.'s Form S-1/A (Reg. No. 333-168127) on August 31, 2010, and incorporated by reference herein) 10.32 Memorandum of Understanding, dated as of September 9, 2010, by and between ACE Cash Express... -

Page 70

..., in the City of Austin, State of Texas on the 1st day of March, 2011. NETSPEND HOLDINGS, INC. By: /s/ DANIEL R. HENRY Daniel R. Henry Chief Executive Officer Pursuant to the requirements of the Securities Act of 1934, as amended, this report has been signed by the following persons in the listed... -

Page 71

... of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements and financial statement schedule based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those... -

Page 72

... party expenses at December 31, 2009 and 2010, respectively) Income tax payable Cardholders' reserve Deferred revenue Long-term debt, current portion Total current liabilities Long-term debt, net of current portion Deferred tax liabilities Other non-current liabilities Total liabilities Commitments... -

Page 73

-

Page 74

..., except per share data) 2010 Operating Revenues (includes related party revenues of $1,590 in 2008, $2,897 in 2009 and $4,611 in 2010) Operating Expenses Direct operating costs (includes related party expenses of $24,408 in 2008, $28,903 in 2009 and $38,625 in 2010) Salaries, benefits, and other... -

Page 75

... of dollars, except share data) Balances at December 31, 2007 44,807,723 $ Repurchase of treasury stock - Stock-based compensation - Exercise of options for common stock - Tax benefit associated with stock options - Exercise of warrants for common stock - Common stock issued for acquisitions... -

Page 76

Vesting of restricted stock Common stock issued in public offering, net of issuance costs (Note 11) Conversion of Class B common stock to common stock Dividend equivalents paid Unrealized loss on availablefor-sale investment Net income Balances at December 31, 2010 - - - 215,050 1 - - - - ... -

Page 77

...Tax benefit associated with stock options Net cash proceeds from initial public offering Proceeds from issuance of long-term debt Issuance costs of long-term debt Principal payment on debt Cash purchase of treasury stock Net cash provided by (used in) financing activities Net change in cash and cash... -

Page 78

... banks") whereby the issuing banks issue MasterCard International ("MasterCard") or Visa USA, Inc. ("Visa") branded cards to customers. The Company's products may be used to purchase goods and services wherever MasterCard and Visa are accepted or to withdraw cash via automatic teller machines ("ATMs... -

Page 79

... -Accounts receivable primarily represents amounts due from cardholders for service and card activation fees and for interchange revenues related to merchant point of sale transactions. These receivables are generally settled by the issuing and merchant acquiring banks within a few days. Accounts... -

Page 80

... arising from processing customer transactions, debit card overdrafts, chargebacks for unauthorized card use, and merchant-related chargebacks due to non-delivery of goods or services. These reserves are established based upon historical loss and recovery rates, and cardholder activity for which... -

Page 81

... services provided, as follows: • Transactions-Cardholders are typically charged a fee for each PIN and signature-based purchase transaction made using their GPR cards, unless the cardholder is on a monthly or annual service plan, in which case the cardholder is instead charged a monthly or annual... -

Page 82

... Company's issuing banks, a variety of bill payment options, custom card designs, and card-to-card transfers of funds through the Company's customer service. Other-Cardholders are charged fees in connection with the activation of the Company's GPR cards and the gift cards at retailers. • Revenue... -

Page 83

...for service and card activation fees and for interchange revenues due from card associations related to merchant point of sale transactions. Cardholder funds and deposits related to the Company's products are held in trust at FDIC insured issuing banks for the benefit of the cardholders. The Company... -

Page 84

... impact on the Company's disclosures. In February 2010, the FASB issued an amendment to the guidelines on accounting for subsequent events. The amendment clarifies that an SEC filer is required to evaluate subsequent events through the date that the financial statements are issued, but that SEC... -

Page 85

... acquisitions of Skylight Financial, Inc. ("Skylight"), a company in the prepaid card industry that is focused on the market for direct deposit payroll accounts, and Procesa International, LLC ("Procesa"), a service provider for direct, cross-border, and cell phone top-up payment services for Latin... -

Page 86

... Company acquired the "Skylight" trade name. Based on the reputation of the Skylight tradename and the anticipated future benefits and cash flows the tradename is expected to contribute, the Company accounts for the tradename as an indefinite lived intangible asset. As part of the Company's annual... -

Page 87

...,000 shares of the common stock of Meta Financial Group, the holding Company of MetaBank, one of the Company's issuing banks, for the purchase price of $3.2 million. The investment in Meta is an available-for-sale security and is included in the Consolidated Balance Sheets as a long-term investment... -

Page 88

... the Company to fund the purchase price and closing costs of the Skylight acquisition, including retiring $40.4 million of existing Skylight debt. In September 2010, the Company entered into a new credit facility with a syndicate of banks with Sun Trust Bank as administrative agent (the "new credit... -

Page 89

.... During the year ended December 31, 2010, the Company did not pay any participation or fronting fees. The terms of the new credit facility require the Company to pay a commitment fee to the administrative agent for the account of each lender, which accrues at a rate per annum equal to 0.45% to... -

Page 90

... transact and considers assumptions market participants would use when pricing the asset or liability, such as inherent risk, transfer restriction, and risk of nonperformance. The Company's financial instruments include cash, cash equivalents, accounts receivable, long-term investments, accounts... -

Page 91

... fully vested options to purchase 890,594 shares of the Company's common stock. The option exercise was transacted through the transfer agent associated with the initial public offering, with 651,085 net shares issued to the employees. The issued shares were sold by the employees in connection with... -

Page 92

... on the Company's Consolidated Statement of Operations, and a $0.2 million cash purchase of 170,000 shares of treasury stock. In 2010, the Company repurchased 1,500,000 shares of its common stock (formerly "class A common stock") for $5.7 million. Dividend Equivalents Certain employee stock options... -

Page 93

...Financial Statements (Continued) December 31, 2008, 2009 and 2010 NOTE 11: STOCKHOLDERS' EQUITY (Continued) Warrants In 2008, the Company issued 22,346 warrants to purchase shares of common stock to a former executive based on a separation agreement at an exercise price of $1.70 per share and issued... -

Page 94

... dividend yield Expected term Risk free rate Weighted average fair value per warrant at issuance date NOTE 12: SHARE BASED PAYMENT Stock Incentive Plans 40% - 3.5 to 5 years 2.1% to 2.3% $1.81 60% - 5 years 1.7% $1.80 As of December 31, 2010, the Company has one stock-based compensation plan... -

Page 95

... of Contents NetSpend Holdings, Inc. Notes to Consolidated Financial Statements (Continued) December 31, 2008, 2009 and 2010 NOTE 12: SHARE BASED PAYMENT (Continued) 0.1 million performance-based options, respectively. The Company did not issue any performance-based options in 2010. During the... -

Page 96

...,740 The aggregate intrinsic value in the table above represents the total pre-tax value, which is calculated as the difference between the Company's stock price on December 31, 2010 and the exercise price, multiplied by the number of in-the-money options that would have been received by the option... -

Page 97

..., while giving consideration to options that have lives less than the contractual terms and vesting schedules in accordance with guidance set by the FASB. The risk-free interest rate assumption is based upon observed interest rates appropriate for the term of the Company's employee stock options. 91 -

Page 98

... 31, 2010, the Company issued 0.7 million shares of restricted stock to its employees that vest annually over three or four year periods. Upon completion of the Company's initial public offering, the vesting of 0.3 million restricted shares accelerated to vest on the date six months following the... -

Page 99

... shares issued and outstanding for the period. The Company calculates basic and diluted earnings (loss) per share using the treasury stock method, the if-converted method and the two-class method, as applicable. Upon completion of the Company's initial public offering in October 2010, all shares... -

Page 100

...of Contents NetSpend Holdings, Inc. Notes to Consolidated Financial Statements (Continued) December 31, 2008, 2009 and 2010 NOTE 14: EARNINGS PER SHARE (Continued) common shares using the treasury stock method, which assumes that the Company will use proceeds from the exercise of stock options and... -

Page 101

-

Page 102

...NetSpend Holdings, Inc. Notes to Consolidated Financial Statements (Continued) December 31, 2008, 2009 and 2010 NOTE 14: EARNINGS PER SHARE (Continued) Years Ended December 31, 2009 2010 Class B Class B Class B Common Common Common Common Common Stock Stock Stock Stock Stock (in thousands of dollars... -

Page 103

... tax assets Deferred revenue Accrued expenses Prepaid card supply costs Net operating loss and tax credit carryforwards Total current deferred tax assets Non-current deferred tax assets Accrued expenses Net operating loss and tax credit carryforwards Unrealized loss on long-term investment Stock... -

Page 104

Table of Contents NetSpend Holdings, Inc. Notes to Consolidated Financial Statements (Continued) December 31, 2008, 2009 and 2010 NOTE 15: INCOME TAXES (Continued) As of December 31, 2010, the Company had approximately $0.3 million of federal net operating losses remaining with limitations on the ... -

Page 105

... vendors to provide card issuance services, card processing services, internet data center services, and other consulting services. The remaining term of the agreements range from one to four years in length and require monthly payments. During the year ended December 31, 2010, the Company recorded... -

Page 106

...the Company's business is conducted through retailers that provide load and reload services to cardholders at their retail locations. Members of the Company's distribution and reload network collect cardholders' funds and remit them by electronic transfer directly to the issuing banks for deposit in... -

Page 107

Table of Contents NetSpend Holdings, Inc. Notes to Consolidated Financial Statements (Continued) December 31, 2008, 2009 and 2010 NOTE 16: COMMITMENTS AND CONTINGENCIES (Continued) intended to cover the risk that it may not recover cardholders' overdrawn account balances were $1.6 million and $4.8... -

Page 108

...the Internal Revenue Code. This plan covers substantially all employees who meet minimum age and service requirements and allows participants to defer a portion of their annual compensation, not to exceed a federally specified maximum, on a pre-tax basis. The Company may contribute to the program by... -

Page 109

...of the Company's gift and GPR cards. The Company incurred expenses from transactions with ACE of $17.1 million, $23.0 million and $31.0 million for the years ended December 31, 2008, 2009 and 2010, respectively. Although revenues generated from cardholders acquired at ACE represent approximately one... -

Page 110

...NetSpend Holdings, Inc. Notes to Consolidated Financial Statements (Continued) December 31, 2008, 2009 and 2010 NOTE 19: SELECTED QUARTERLY RESULTS OF OPERATIONS (unaudited) (Continued) Holdings I, LLC, which resulted in the conversion of all shares of the Company's outstanding class B common stock... -

Page 111

...manager and processor. The Company expects to begin issuing general-purpose reloadable prepaid debit cards in collaboration with The Bancorp Bank in April 2011. In February 2011, the Company granted 1.4 million options to employees and issued 15,203 shares of restricted stock to members of the board... -

Page 112

... information is shown in the consolidated financial statements, or notes thereto, included herein. Schedule II NETSPEND HOLDINGS, INC. VALUATION AND QUALIFYING ACCOUNTS (in thousands of dollars) Cardholders' Reserve for the Year Ended December 31, Balance at Beginning of Period Additional Charges... -

Page 113

... by reference herein) 10.2 Pledge and Security Agreement, dated as of September 24, 2010, by and among NetSpend Holdings, Inc., NetSpend Corporation, Skylight Acquisition I, Inc., Skylight Financial, Inc., NetSpend Payment Services and SunTrust Bank, as Administrative Agent (filed as Exhibit 10.2 to... -

Page 114

... by reference herein) 10.20 Second Amended and Restated Card Program Management Agreement, dated as of February 1, 2010, by and between MetaBank, dba Meta Payment Systems, and NetSpend Corporation (filed as Exhibit 10.20 to NetSpend Holdings, Inc.'s Form S-1/A (Reg. No. 333-168127) on September... -

Page 115

Table of Contents Exhibit Number Description of Exhibits 10.21 Card Program Management Agreement, dated as of February 1, 2010, by and between MetaBank, dba Meta Payment Systems, and Skylight Financial, Inc. (filed as Exhibit 10.21 to NetSpend Holdings, Inc.'s Form S-1/A (Reg. No. 333-168127) on ... -

Page 116

Table of Contents Exhibit Number Description of Exhibits 31.2 Certification of Chief Financial Officer of NetSpend pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 32.1 Certification of the Chief Executive Officer and the Chief Financial Officer of NetSpend pursuant to Section 906 of the ... -

Page 117

-

Page 118

... in stockholders' equity and cash flows for each of the years in the three-year period ended December 31, 2010, and related financial statement schedule II, which report appears in the December 31, 2010 annual report on Form 10-K of Netspend Holdings, Inc. /s/ KPMG LLP Austin, Texas March 1, 2011 -

Page 119

-

Page 120

... information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. (b) Date: March 1, 2011 By: Name: Title: /s/ DANIEL R. HENRY Daniel R. Henry Chief Executive Officer... -

Page 121

QuickLinks Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 -

Page 122

... information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. (b) Date: March 1, 2011 By: Name: Title: /s/ GEORGE W. GRESHAM George W. Gresham Chief Financial Officer... -

Page 123

QuickLinks Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 -

Page 124

... the Securities Exchange Act of 1934; and the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. By: Name: Title: Date: March 1, 2011 /s/ DANIEL R. HENRY Daniel R. Henry Chief Executive Officer A signed... -

Page 125

QuickLinks Certification of CEO Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 -

Page 126

... In connection with the Annual Report of NetSpend Holdings, Inc. (the "Company") on Form 10-K for the year ended December 31, 2010 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, George W. Gresham, as Chief Financial Officer of the Company, hereby certify... -

Page 127

QuickLinks Certification of CEO Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002