Motorola 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

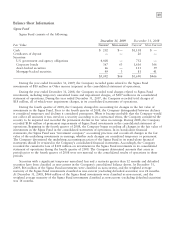

Investments

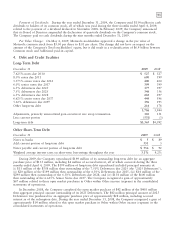

Investments consist of the following:

Recorded Value Less

Short-term Unrealized Unrealized Cost

December 31, 2009 Investments Investments Gains Losses Basis

Available-for-sale securities:

U.S. government and agency obligations $ — $ 23 $ 1 $— $ 22

Corporate bonds 2 10 — — 12

Mortgage-backed securities — 3 — — 3

Common stock and equivalents — 147 111 (1) 37

2 183 112 (1) 74

Other securities, at cost — 223 — — 223

Equity method investments — 53 — — 53

$ 2 $ 459 $112 $(1) $350

Recorded Value Less

Short-term Unrealized Unrealized Cost

December 31, 2008 Investments Investments Gains Losses Basis

Certificates of deposit $225 $ — $— $— $225

Available-for-sale securities:

U.S. government and agency obligations — 28 1 — 27

Corporate bonds — 11 — — 11

Asset-backed securities — 1 — — 1

Mortgage-backed securities — 4 — — 4

Common stock and equivalents — 117 5 (2) 114

225 161 6 (2) 382

Other securities, at cost — 296 — — 296

Equity method investments — 60 — — 60

$225 $517 $ 6 $(2) $738

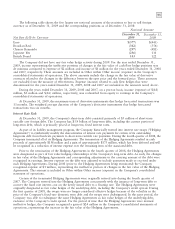

At December 31, 2009 and 2008, the Company had $2 million and $225 million, respectively, in short-term

investments (which are highly-liquid fixed-income investments with an original maturity greater than three

months but less than one year).

At December 31, 2009, the Company’s available-for-sale securities portfolio had an approximate fair market

value of $185 million, which represented a cost basis of $74 million and a net unrealized gain of $111 million.

At December 31, 2008, the Company’s available-for-sale securities portfolio had an approximate fair market

value of $161 million, which represented a cost basis of $157 million and a net unrealized gain of $4 million.

During the years ended December 31, 2009, 2008 and 2007, the Company recorded investment impairment

charges of $77 million, $365 million and $44 million, respectively, representing other-than-temporary declines in

the value of the Company’s available-for-sale investment portfolio. Investment impairment charges are included in

Other within Other income (expense) in the Company’s consolidated statements of operations.

Gains on sales of investments and businesses, consists of the following:

Years Ended December 31 2009 2008 2007

Gains on sales of investments, net $92 $82 $17

Gains (loss) on sales of businesses, net (4) —33

$88 $82 $50