Motorola 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

insurance arrangement. As a result of the adoption of this new guidance, the Company recorded a liability

representing the actuarial present value of the future death benefits as of the employees’ expected retirement date

of $45 million with the offset reflected as a cumulative-effect adjustment to January 1, 2008 Retained earnings

and Accumulated other comprehensive income (loss) in the amounts of $4 million and $41 million, respectively,

in the Company’s consolidated statement of stockholders’ equity. It is currently expected that minimal, if any,

further cash payments will be required to fund these policies.

The net periodic cost for these split-dollar life insurance arrangements was $6 million in both the years ended

December 31, 2009 and 2008. The Company has recorded a liability representing the actuarial present value of

the future death benefits as of the employees’ expected retirement date of $48 million and $47 million as of

December 31, 2009 and December 31, 2008, respectively.

Defined Contribution Plan

The Company and certain subsidiaries have various defined contribution plans, in which all eligible

employees participate. In the U.S., the 401(k) plan is a contributory plan. Matching contributions are based upon

the amount of the employees’ contributions. Effective January 1, 2005, newly hired employees have a higher

maximum matching contribution at 4% on the first 5% of employee contributions, compared to 3% on the first

6% of employee contributions for employees hired prior to January 2005. Effective January 1, 2009, the

Company temporarily suspended all matching contributions to the Motorola 401(k) plan. The Company’s

expenses, primarily relating to the employer match, for all defined contribution plans, for the years ended

December 31, 2009, 2008 and 2007 were $8 million, $95 million and $116 million, respectively.

8. Share-Based Compensation Plans and Other Incentive Plans

Stock Options, Stock Appreciation Rights and Employee Stock Purchase Plan

The Company grants options to acquire shares of common stock to certain employees, and existing option

holders in connection with the merging of option plans following an acquisition. Each option granted and stock

appreciation right has an exercise price of no less than 100% of the fair market value of the common stock on

the date of the grant. The awards have a contractual life of five to ten years and vest over two to four years.

Stock options and stock appreciation rights assumed or replaced with comparable stock options or stock

appreciation rights in conjunction with a change in control only become exercisable if the holder is also

involuntarily terminated (for a reason other than cause) or quits for good reason within 24 months of a change in

control.

The employee stock purchase plan allows eligible participants to purchase shares of the Company’s common

stock through payroll deductions of up to 10% of eligible compensation on an after-tax basis. Plan participants

cannot purchase more than $25,000 of stock in any calendar year. The price an employee pays per share is 85%

of the lower of the fair market value of the Company’s stock on the close of the first trading day or last trading

day of the purchase period. The plan has two purchase periods, the first one from October 1 through March 31

and the second one from April 1 through September 30. For the years ended December 31, 2009, 2008 and

2007, employees purchased 29.4 million, 18.9 million and 10.2 million shares, respectively, at purchase prices of

$3.60 and $3.68, $7.91 and $6.07, and $14.93 and $15.02, respectively.

The Company calculates the value of each employee stock option, estimated on the date of grant, using the

Black-Scholes option pricing model. The weighted-average estimated fair value of employee stock options granted

during 2009, 2008 and 2007 was $2.78, $3.47 and $5.95, respectively, using the following weighted-average

assumptions:

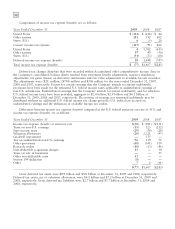

2009 2008 2007

Expected volatility 57.1% 56.4% 28.3%

Risk-free interest rate 1.9% 2.4% 4.5%

Dividend yield 0.0% 2.7% 1.1%

Expected life (years) 3.9 5.5 6.5