Motorola 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

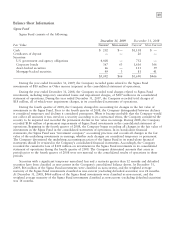

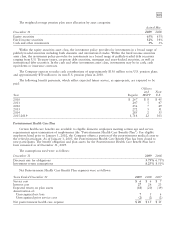

Significant components of deferred tax assets (liabilities) are as follows:

December 31 2009 2008

Inventory $ 312 $ 308

Accrued liabilities and allowances 358 483

Employee benefits 1,388 1,235

Capitalized items 551 468

Tax basis differences on investments 90 171

Depreciation tax basis differences on fixed assets 29 37

Undistributed non-U.S. earnings (235) (278)

Tax carryforwards 3,240 3,001

Available-for-sale securities (41) (1)

Business reorganization 53 70

Warranty and customer reserves 210 215

Deferred revenue and costs 199 184

Valuation allowances (2,907) (2,692)

Deferred charges 51 45

Other 35 225

$ 3,333 $ 3,471

The Company accounts for income taxes by recognizing deferred tax assets and liabilities using enacted tax

rates for the effect of the temporary differences between the book and tax basis of recorded assets and liabilities.

The Company makes estimates and judgments with regard to the calculation of certain income tax assets and

liabilities. Deferred tax assets are reduced by valuation allowances if, based on the consideration of all available

evidence, it is more likely than not that some portion of the deferred tax asset will not be realized. Significant

weight is given to evidence that can be objectively verified.

The Company evaluates deferred income taxes on a quarterly basis to determine if valuation allowances are

required by considering available evidence, including historical and projected taxable income and tax planning

strategies that are both prudent and feasible. As of December 31, 2009, the Company’s U.S. operations had

generated three consecutive years of pre-tax losses, which are attributable to the Mobile Devices segment. During

2007, 2008 and 2009, the Home and Networks Mobility and Enterprise Mobility Solution businesses were

profitable in the U.S. and worldwide. Because of the 2007, 2008 and 2009 losses at Mobile Devices, the

Company believes that the weight of negative historic evidence precludes it from considering any forecasted

income from the Mobile Devices business in its analysis of the recoverability of deferred tax assets. However,

based on the sustained profits of the other businesses, the Company believes that the weight of positive historic

evidence allows it to include forecasted income from the other businesses in its analysis of the recoverability of its

deferred tax assets. The Company also considered in its analysis tax planning strategies that are prudent and can

be reasonably implemented. During 2008, the Company recorded a partial valuation allowance of $2.1 billion

against a portion of its U.S. tax carry forwards that were more likely than not to expire. During 2009, the

Company increased its U.S. valuation allowance by $90 million, primarily relating to capital losses realized from

the disposition of a subsidiary, which is accounted for as part of discontinued operations, offset by a decrease in

the valuation allowance for refundable general business credits. The Company recorded additional valuation

allowances relating to tax carryforwards and deferred tax assets of non-U.S. subsidiaries, including Brazil and

Mexico that the Company believes are more likely than not to expire or go unused.

At December 31, 2009 and 2008, the Company had valuation allowances of $2.9 billion and $2.7 billion,

respectively, against its deferred tax assets, including $422 million and $297 million, respectively, relating to

deferred tax assets for non-U.S. subsidiaries. The Company’s valuation allowances for its non-U.S. subsidiaries

had a net increase of $125 million during 2009. The increase is primarily caused by exchange rate variances and

the creation of additional valuation allowances in Brazil and Mexico. The U.S. valuation allowance relates

primarily to tax carryforwards, including foreign tax credits, general business credits and tax carryforwards of

acquired businesses which have limitations upon their use, state tax carryforwards and future capital losses

related to certain investments. The Company believes that the remaining deferred tax assets are more likely than

not to be realizable based on estimates of future taxable income and the implementation of tax planning

strategies.