Motorola 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

At December 31, 2009, the Company had unrecognized compensation expense related to RSUs of

$269 million, net of estimated forfeitures, expected to be recognized over the weighted average period of

approximately three years. The total fair value of RS and RSU shares vested during the years ended December 31,

2009, 2008 and 2007 was $44 million, $19 million and $13 million, respectively. The aggregate fair value of

outstanding RSUs as of December 31, 2009 was $438 million.

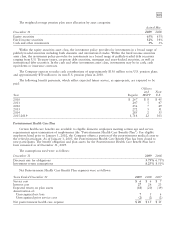

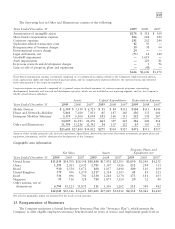

Total Share-Based Compensation Expense

Compensation expense for the Company’s employee stock options, stock appreciation rights, employee stock

purchase plans, RS and RSUs was as follows:

Year Ended December 31 2009 2008 2007

Share-based compensation expense included in:

Costs of sales $32$32$33

Selling, general and administrative expenses 170 155 188

Research and development expenditures 94 93 94

Share-based compensation expense included in Operating earnings (loss) 296 280 315

Tax benefit 95 86 99

Share-based compensation expense, net of tax $ 201 $ 194 $ 216

Increase in basic loss per share $(0.09) $(0.09) $(0.09)

Increase in diluted loss per share $(0.09) $(0.09) $(0.09)

Motorola Incentive Plan

The Motorola Incentive Plan provides eligible employees with an annual payment, calculated as a percentage

of an employee’s eligible earnings, in the year after the close of the current calendar year if specified business

goals and individual performance targets are met. The provisions for awards under these incentive plans for the

years ended December 31, 2009, 2008 and 2007 were $190 million, $172 million and $190 million, respectively.

Long-Range Incentive Plan

The Long-Range Incentive Plan (‘‘LRIP’’) rewards participating elected officers for the Company’s

achievement of specified business goals during the period, based on two performance objectives measured over

three-year cycles. The provision for LRIP (net of the reversals of previously recognized reserves) for the years

ended December 31, 2009, 2008 and 2007 was $9 million, $(13) million and $(8) million, respectively.

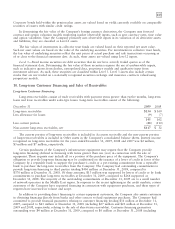

9. Fair Value Measurements

The Company adopted new accounting guidance on measuring fair value on January 1, 2008 for all financial

assets and liabilities and non-financial assets and liabilities that are recognized or disclosed at fair value in the

financial statements on a recurring basis. This does not change the accounting for those instruments that were,

under previous U.S. GAAP, accounted for at cost or contract value. The Company has no non-financial assets and

liabilities that are required to be measured at fair value on a recurring basis as of December 31, 2009.

The Company holds certain fixed income securities, equity securities and derivatives, which must be

measured using the authoritative accounting guidance for fair value hierarchy and related valuation

methodologies. The guidance specifies a hierarchy of valuation techniques based on whether the inputs to each

measurement are observable or unobservable. Observable inputs reflect market data obtained from independent

sources, while unobservable inputs reflect the Company’s assumptions about current market conditions. The

prescribed fair value hierarchy and related valuation methodologies are as follows:

Level 1—Quoted prices for identical instruments in active markets.

Level 2—Quoted prices for similar instruments in active markets, quoted prices for identical or similar

instruments in markets that are not active and model-derived valuations, in which all significant inputs are

observable in active markets.

Level 3—Valuations derived from valuation techniques, in which one or more significant inputs are

unobservable.