Motorola 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

The Company uses the implied volatility for traded options on the Company’s stock as the expected volatility

assumption required in the Black-Scholes model. The selection of the implied volatility approach was based upon

the availability of actively traded options on the Company’s stock and the Company’s assessment that implied

volatility is more representative of future stock price trends than historical volatility.

The risk-free interest rate assumption is based upon the average daily closing rates during the year for U.S.

treasury notes that have a life which approximates the expected life of the option. The dividend yield assumption

is based on the Company’s future expectation of dividend payouts. The expected life of employee stock options

represents the average of the contractual term of the options and the weighted-average vesting period for all

option tranches.

The Company has applied a forfeiture rate, estimated based on historical data, of 13%-45% to the option

fair value calculated by the Black-Scholes option pricing model. This estimated forfeiture rate is applied to grants

based on their remaining vesting term and may be revised in subsequent periods if actual forfeitures differ from

this estimate.

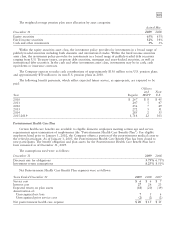

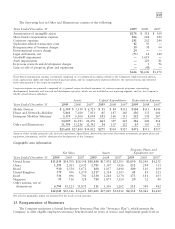

Stock option activity was as follows (in thousands, except exercise price and employee data):

2009 2008 2007

Shares Wtd. Avg. Shares Wtd. Avg. Shares Wtd. Avg.

Subject to Exercise Subject to Exercise Subject to Exercise

Years Ended December 31 Options Price Options Price Options Price

Options outstanding at January 1 228,145 $17 224,255 $19 233,445 $18

Options granted 62,576 6 39,764 8 40,257 18

Options exercised (1,439) 6 (1,920) 7 (26,211) 11

Options terminated, canceled or

expired (127,855) 18 (33,954) 18 (23,236) 19

Options outstanding at December 31 161,427 12 228,145 17 224,255 19

Options exercisable at December 31 77,260 17 148,072 19 138,741 19

Approx. number of employees

granted options 22,095 3,300 32,000

At December 31, 2009, the Company had $171 million of total unrecognized compensation expense, net of

estimated forfeitures, related to stock option plans and the employee stock purchase plan that will be recognized

over the weighted average period of approximately one year. Cash received from stock option exercises and the

employee stock purchase plan was $116 million, $145 million and $440 million for the years ended

December 31, 2009, 2008 and 2007, respectively. The total intrinsic value of options exercised during the years

ended December 31, 2009, 2008 and 2007 was $1 million, $2 million and $177 million, respectively. The

aggregate intrinsic value for options outstanding and exercisable as of December 31, 2009 was $128 million and

$27 million, respectively, based on a December 31, 2009 stock price of $7.76 per share.

At December 31, 2009 and 2008, 60.5 million shares and 72.2 million shares, respectively, were available for

future share-based award grants under the 2006 Motorola Omnibus Plan, covering all equity awards to

employees and non-employee directors.