Motorola 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In 2008, sales to the segment’s top five customers represented approximately 45% of the segment’s net sales.

The segment’s backlog was $2.3 billion at December 31, 2008, compared to $2.6 billion at December 31, 2007.

In 2008, our digital video customers significantly increased their purchases of the segment’s products and

services, primarily due to increased demand for digital entertainment devices, particularly IP and HD/DVR

devices.

In February 2008, the segment acquired the assets related to digital cable set-top products of Zhejiang Dahua

Digital Technology Co., LTD and Hangzhou Image Silicon (known collectively as Dahua Digital), a developer,

manufacturer and marketer of cable set-tops and related low-cost integrated circuits for the emerging Chinese

cable business. The acquisition helped the segment strengthen its position in the rapidly growing cable market in

China.

Enterprise Mobility Solutions Segment

The Enterprise Mobility Solutions segment designs, manufactures, sells, installs and services analog and

digital two-way radios, wireless LAN and security products, voice and data communications products and

systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide

range of customers, including government and public safety agencies (which, together with all sales to distributors

of two-way communication products, are referred to as the ‘‘government and public safety market’’), as well as

retail, energy and utilities, transportation, manufacturing, healthcare and other commercial customers (which,

collectively, are referred to as the ‘‘commercial enterprise market’’). In 2009, the segment’s net sales represented

32% of the Company’s consolidated net sales, compared to 27% in 2008 and 21% in 2007.

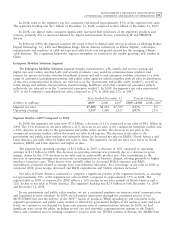

Years Ended December 31 Percent Change

(Dollars in millions) 2009 2008 2007 2009—2008 2008—2007

Segment net sales $7,008 $8,093 $7,729 (13)% 5%

Operating earnings 1,057 1,496 1,213 (29)% 23%

Segment Results—2009 Compared to 2008

In 2009, the segment’s net sales were $7.0 billion, a decrease of 13% compared to net sales of $8.1 billion in

2008. The 13% decrease in net sales reflects a 21% decrease in net sales to the commercial enterprise market and

a 10% decrease in net sales to the government and public safety market. The decrease in net sales to the

commercial enterprise market reflects decreased net sales in all regions. The decrease in net sales to the

government and public safety market was primarily driven by decreased net sales in EMEA, North America and

Latin America, partially offset by higher net sales in Asia. The segment’s overall net sales were lower in North

America, EMEA and Latin America and higher in Asia

The segment had operating earnings of $1.1 billion in 2009, a decrease of 29% compared to operating

earnings of $1.5 billion in 2008. The decrease in operating earnings was primarily due to a decrease in gross

margin, driven by the 13% decrease in net sales and an unfavorable product mix. Also contributing to the

decrease in operating earnings was an increase in reorganization of business charges, relating primarily to higher

employee severance costs. These factors were partially offset by decreased SG&A expenses and R&D

expenditures, primarily related to savings from cost-reduction initiatives. As a percentage of net sales in 2009 as

compared 2008, gross margin decreased and R&D expenditures and SG&A expenses increased.

Net sales in North America continued to comprise a significant portion of the segment’s business, accounting

for approximately 58% of the segment’s net sales in 2009, compared to approximately 57% in 2008. The

regional shift in 2009 as compared to 2008 reflects a 16% decline in net sales outside of North America and a

12% decline in net sales in North America. The segment’s backlog was $2.4 billion at both December 31, 2009

and December 31, 2008.

In our government and public safety market, we see a continued emphasis on mission-critical communication

and homeland security solutions. In 2009, we led market innovation through the continued success of our

MOTOTRBO line and the delivery of the APX family of products. While spending by end customers in the

segment’s government and public safety market is affected by government budgets at the national, state and local

levels, we continue to see demand for large-scale mission critical communications systems. In 2009, we had

significant wins across the globe, including several city and statewide communications systems in the United

States, and continued success winning competitive projects with our TETRA systems in Europe, the Middle East