Motorola 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

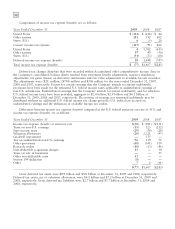

The weighted-average asset allocation for plan assets by asset categories:

Actual Mix

December 31 2009 2008

Equity securities 67% 64%

Fixed income securities 30% 32%

Cash and other investments 3% 4%

Within the equity securities asset class, the investment policy provides for investments in a broad range of

publicly-traded securities including both domestic and international stocks. Within the fixed income securities

asset class, the investment policy provides for investments in a broad range of publicly-traded debt securities

ranging from U.S. Treasury issues, corporate debt securities, mortgages and asset-backed issues, as well as

international debt securities. In the cash asset class, investments may be in cash and cash equivalents.

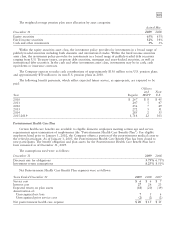

The Company expects to make no cash contributions to the Postretirement Health Care plan in 2010. The

following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Year

2010 $40

2011 38

2012 36

2013 34

2014 33

2015-2019 163

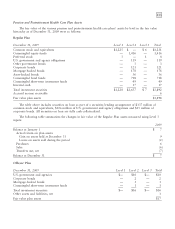

The health care trend rate used to determine the December 31, 2009 accumulated postretirement benefit

obligation is 8.5% for 2010. Beyond 2010, the rate is assumed to decrease by about 0.7% per year until it

reaches 5% by 2015 and then remains flat. The health care trend rate used to determine the December 31, 2008

accumulated postretirement benefit obligation was 8.5%.

Changing the health care trend rate by one percentage point would change the accumulated postretirement

benefit obligation and the net retiree health care expense as follows:

1% Point 1% Point

Increase Decrease

Increase (decrease) in:

Accumulated postretirement benefit obligation $17 $(14)

Net retiree health care expense 1 (1)

The Company maintains a lifetime cap on postretirement health care costs, which reduces the liability

duration of the plan. A result of this lower duration is a decreased sensitivity to a change in the discount rate

trend assumption with respect to the liability and related expense.

The Company has no significant postretirement health care benefit plans outside the United States.

Other Benefit Plans

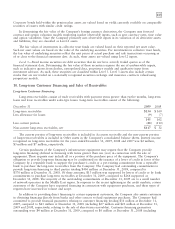

The Company maintains a number of endorsement split-dollar life insurance policies that were taken out on

now-retired officers under a plan that was frozen prior to December 31, 2004. The Company had purchased the

life insurance policies to insure the lives of employees and then entered into a separate agreement with the

employees that split the policy benefits between the Company and the employee. Motorola owns the policies,

controls all rights of ownership, and may terminate the insurance policies. To effect the split-dollar arrangement,

Motorola endorsed a portion of the death benefits to the employee and upon the death of the employee, the

employee’s beneficiary typically receives the designated portion of the death benefits directly from the insurance

company and the Company receives the remainder of the death benefits.

The Company adopted new accounting guidance on accounting for split-dollar life insurance arrangements as

of January 1, 2008. This guidance requires that a liability for the benefit obligation be recorded because the

promise of postretirement benefit had not been settled through the purchase of an endorsement split-dollar life