Motorola 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

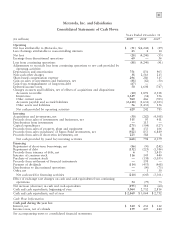

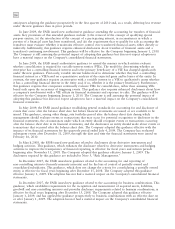

80

Motorola, Inc. and Subsidiaries

Consolidated Statements of Stockholders’ Equity

Motorola, Inc. Shareholders

Accumulated Other Comprehensive Income (Loss)

Fair Value

Common Adjustment Foreign

Stock and To Available Currency Retirement

Additional For Sale Translation Benefits Other

Paid-In Securities, Adjustments, Adjustments, Items, Retained Noncontrolling Comprehensive

(In millions, except per share amounts) Shares Capital Net of Tax Net of Tax Net of Tax Net of Tax Earnings Interests Earnings (Loss)

Balances at January 1, 2007 2,399.1 $ 9,799 $ 37 $(126) $(1,577) $ 16 $ 9,096 $ 44

Net earnings (loss) (49) 14 $ (35)

Net unrealized losses on securities, net of tax of

($58) (96) (96)

Foreign currency translation adjustments, net of

tax of $3 142 142

Purchases of a Noncontrolling interest equity 20

Amortization of retirement benefits adjustments,

net of tax of $39 62 62

Year-end and other retirement adjustments, net of

tax of $328 852 852

Issuance of common stock and stock options

exercised 36.1 443

Share repurchase program (171.2) (3,035)

Excess tax benefits from share-based compensation 50

Share-based compensation expense 317

Net loss on derivative instruments, net of tax of

($6) (16) (16)

Dividends declared ($0.20 per share) (468)

Balances at December 31, 2007 2,264.0 $ 7,574 $(59) $ 16 $ (663) $ — $ 8,579 $ 78 $ 909

Cumulative effect—Postretirement Insurance Plan (41) (4)

Balances at January 1, 2008 2,264.0 $ 7,574 $(59) $ 16 $ (704) $ — $ 8,575 $ 78

Net earnings (loss) (4,244) 4 $(4,240)

Net unrealized gains on securities, net of tax of

$36 61 61

Foreign currency translation adjustments, net of

tax of $39 (149) (149)

Purchases of a Noncontrolling interest equity 6

Amortization of retirement benefit adjustments net

of tax of $10 19 19

Effect of U.S. pension plan freeze curtailment, net

of tax of ($25) (42) (42)

Year-end and other retirement adjustments, net of

tax of ($793) (1,340) (1,340)

Issuance of common stock and stock options

exercised 21.9 134

Share repurchase program (9.0) (138)

Tax shortfalls from share-based compensation (6)

Share-based compensation expense 270

Net loss on derivative instruments, net of tax of

($5) (7) (7)

Dividends declared ($0.20 per share) (453)

Balances at December 31, 2008 2,276.9 $ 7,834 $ 2 $(133) $(2,067) $ (7) $ 3,878 $ 88 $(5,698)

Net earnings (loss) (51) 23 $ (28)

Net unrealized gain on securities, net of tax of $40 68 68

Foreign currency translation adjustments, net of

tax of ($17) 70 70

Amortization of retirement benefit adjustments, net

of tax of ($33) (65) (65)

Year-end and other retirement adjustments, net of

tax of ($22) (163) (163)

Issuance of common stock and stock options

exercised 37.3 111

Tax shortfalls from stock-based compensation (12)

Share-based compensation expense 301

Net gain on derivative instruments, net of tax of

$6 99

Dividends paid to noncontrolling interest on

subsidiary common stock (3)

Balances at December 31, 2009 2,314.2 $ 8,234 $ 70 $ (63) $(2,295) $ 2 $ 3,827 $108 $ (109)

See accompanying notes to consolidated financial statements.