Motorola 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

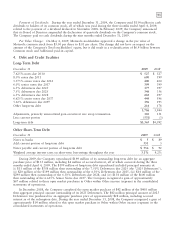

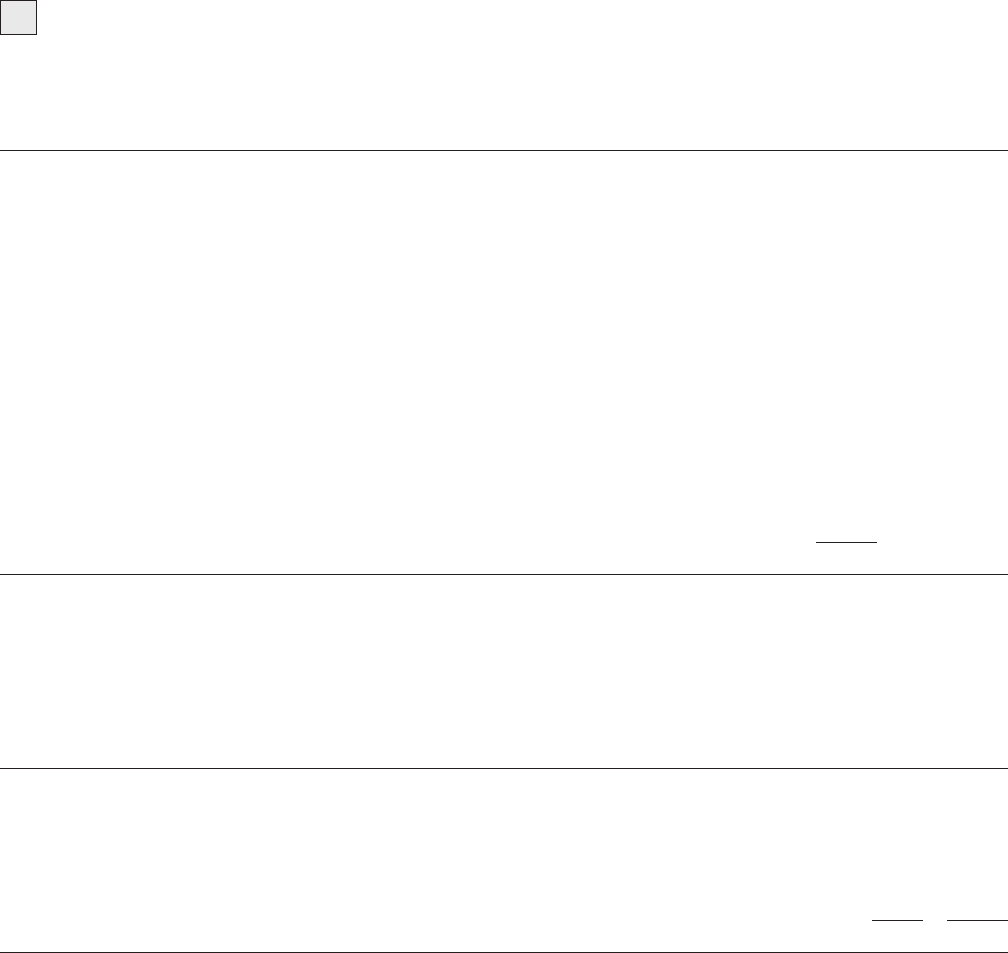

Tax carryforwards are as follows:

Gross Tax Expiration

December 31, 2009 Tax Loss Effected Period

United States:

U.S. tax losses $ 694 $ 243 2018-2028

Foreign tax credits n/a 1,972 2011-2019

General business credits n/a 343 2017-2029

Minimum tax credits n/a 109 Unlimited

State tax losses 3,758 115 2010-2029

State tax credits n/a 51 2010-2025

Non-U.S. Subsidiaries:

Brazil tax losses 195 66 Unlimited

China tax losses 76 16 2012-2014

United Kingdom tax losses 272 76 Unlimited

Germany tax losses 290 84 Unlimited

Singapore tax losses 138 23 Unlimited

Other subsidiaries tax losses 84 26 Various

Spain tax credits n/a 32 2014-2022

Other subsidiaries tax credits n/a 84 Unlimited

$3,240

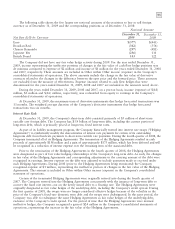

The Company had unrecognized tax benefits of $466 million and $914 million at December 31, 2009 and

December 31, 2008, respectively, of which approximately $100 million and $580 million, respectively, if

recognized, would affect the effective tax rate, net of resulting changes to valuation allowances.

A roll-forward of unrecognized tax benefits, including those attributable to discontinued operations, is as

follows:

2009 2008

Balance at January 1 $ 914 $1,400

Additions based on tax positions related to current year 29 46

Additions for tax positions of prior years 60 141

Reductions for tax positions of prior years (96) (642)

Settlements (439) (31)

Lapse of statute of limitations (2) —

Balance at December 31 $ 466 $ 914

During the second quarter of 2009, the Company concluded its Internal Revenue Service (‘‘IRS’’) audits for

tax years 1996-2003. As a result of the foregoing and resolution of certain Non-U.S. audits, the Company

reduced its unrecognized tax benefits by $463 million, of which $31 million was recognized as a tax benefit and

the remainder primarily reduced tax carry forwards and other deferred tax assets. In relation to the Company’s

1996-2003 IRS audit resolution, the Company received a $126 million tax refund and $62 million interest refund

during the third quarter of 2009. The refunds primarily relate to tax refund claims dating prior to the 1996-2003

audit cycle, which were held pending the final resolution of the 1996-2003 audit cycle. In the fourth quarter of

2009, the Company recognized $16 million of previously unrecognized tax benefits, which resulted from the

favorable resolution of a matter with Non-U.S. tax authorities.