Motorola 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

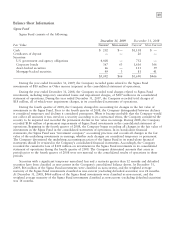

93

Payment of Dividends: During the year ended December 31, 2009, the Company paid $114 million in cash

dividends to holders of its common stock, all of which was paid during the three months ended April 4, 2009,

related to the payment of a dividend declared in November 2008. In February 2009, the Company announced

that its Board of Directors suspended the declaration of quarterly dividends on the Company’s common stock.

The Company paid no cash dividends during the nine months ended December 31, 2009.

Par Value Change: On May 4, 2009, Motorola stockholders approved a change in the par value of

Motorola common stock from $3.00 per share to $.01 per share. The change did not have an impact on the

amount of the Company’s Total stockholders’ equity, but it did result in a reclassification of $6.9 billion between

Common stock and Additional paid-in capital.

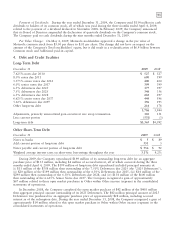

4. Debt and Credit Facilities

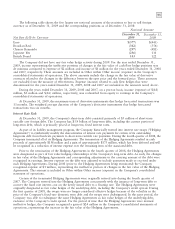

Long-Term Debt

December 31 2009 2008

7.625% notes due 2010 $ 527 $ 527

8.0% notes due 2011 600 599

5.375% senior notes due 2012 400 400

6.0% senior notes due 2017 399 399

6.5% debentures due 2025 377 397

7.5% debentures due 2025 346 356

6.5% debentures due 2028 283 297

6.625% senior notes due 2037 444 596

5.22% debentures due 2097 196 195

Other long-term debt 214 178

3,786 3,944

Adjustments, primarily unamortized gain on interest rate swap termination 110 151

Less: current portion (531) (3)

Long-term debt $3,365 $4,092

Other Short-Term Debt

December 31 2009 2008

Notes to banks $5$89

Add: current portion of long-term debt 531 3

Notes payable and current portion of long-term debt $ 536 $92

Weighted average interest rates on short-term borrowings throughout the year 3.1% 4.2%

During 2009, the Company repurchased $199 million of its outstanding long-term debt for an aggregate

purchase price of $133 million, including $4 million of accrued interest, all of which occurred during the three

months ended April 4, 2009. The $199 million of long-term debt repurchased included principal amounts of:

(i) $11 million of the $358 million then outstanding of the 7.50% Debentures due 2025 (the ‘‘2025 Debentures’’),

(ii) $20 million of the $399 million then outstanding of the 6.50% Debentures due 2025, (iii) $14 million of the

$299 million then outstanding of the 6.50% Debentures due 2028, and (iv) $154 million of the $600 million

then outstanding of the 6.625% Senior Notes due 2037. The Company recognized a gain of approximately

$67 million related to these open market purchases in Other within Other income (expense) in the consolidated

statements of operations.

In December 2008, the Company completed the open market purchase of $42 million of the $400 million

then aggregate principal amount outstanding of its 2025 Debentures. The $42 million principal amount of 2025

Debentures was purchased for an aggregate purchase price of approximately $28 million, including accrued

interest as of the redemption date. During the year ended December 31, 2008, the Company recognized a gain of

approximately $14 million related to this open market purchase in Other within Other income (expense) in the

consolidated statements of operations.