Motorola 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

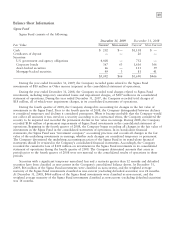

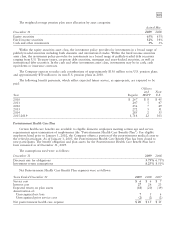

The following table summarizes the losses recognized in the consolidated financial statements:

Foreign Exchange Financial Statement

Year Ended December 31, 2009 Contracts Location

Derivatives in cash flow hedging relationships:

Loss recognized in Accumulated other

comprehensive loss (effective portion) $ — Accumulated other comprehensive loss

Loss reclassified from Accumulated other

comprehensive loss into Net earnings (loss)

(effective portion) (18) Cost of sales/Sales

Gain (loss) recognized in Net earnings (loss) on

derivative (ineffective portion and amount

excluded from effectiveness testing) — Other income (expense)

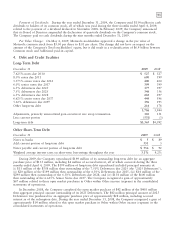

Stockholders’ Equity

Derivative instruments activity, net of tax, included in Accumulated other comprehensive income (loss) within

the consolidated statements of stockholders’ equity for the years ended December 31, 2009, 2008 and 2007 is as

follows:

2009 2008 2007

Balance at January 1 $(7) $— $16

Increase (decrease) in fair value 21 (9) (6)

Reclassifications to earnings (12) 2 (10)

Balance at December 31 $2 $(7) $—

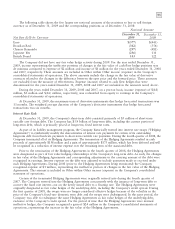

Fair Value of Financial Instruments

The Company’s financial instruments include cash equivalents, Sigma Fund investments, short-term

investments, accounts receivable, long-term receivables, accounts payable, accrued liabilities, derivative financial

instruments and other financing commitments. The Company’s Sigma Fund, available-for-sale investment

portfolios and derivative financial instruments are recorded in the Company’s consolidated balance sheets at fair

value. All other financial instruments, with the exception of long-term debt, are carried at cost, which is not

materially different than the instruments’ fair values.

Using quoted market prices and market interest rates, the Company determined that the fair value of

long-term debt at December 31, 2009 was $3.7 billion, compared to a face value of $3.9 billion. Since

considerable judgment is required in interpreting market information, the fair value of the long-term debt is not

necessarily indicative of the amount which could be realized in a current market exchange.

Equity Price Market Risk

At December 31, 2009, the Company’s available-for-sale equity securities portfolio had an approximate fair

market value of $147 million, which represented a cost basis of $37 million and a net unrealized gains of

$110 million. These equity securities are held for purposes other than trading.

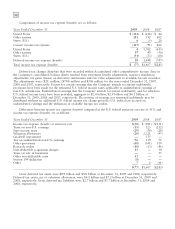

6. Income Taxes

Components of earnings (loss) from continuing operations before income taxes are as follows:

Years Ended December 31 2009 2008 2007

United States $(882) $(3,880) $(2,540)

Other nations 717 1,247 2,164

$(165) $(2,633) $ (376)