Motorola 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

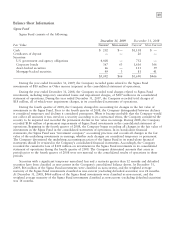

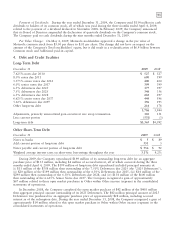

Balance Sheet Information

Sigma Fund

Sigma Fund consists of the following:

December 31, 2009 December 31, 2008

Fair Value Current Non-current Current Non-Current

Cash $ 202 $— $1,108 $ —

Certificates of deposit — — 20 —

Securities:

U.S. government and agency obligations 4,408 — 752 —

Corporate bonds 367 63 1,616 366

Asset-backed securities 66 — 113 59

Mortgage-backed securities 49 3 81 41

$5,092 $66 $3,690 $466

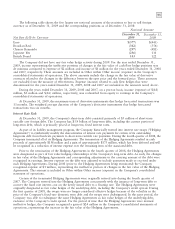

During the year ended December 31, 2009, the Company recorded gains related to the Sigma Fund

investments of $80 million in Other income (expense) in the consolidated statement of operations.

During the year ended December 31, 2008, the Company recorded total charges related to Sigma Fund

investments, including temporary unrealized losses and impairment charges, of $287 million in its consolidated

statement of operations. During the year ended December 31, 2007, the Company recorded total charges of

$18 million, all of which were impairment charges, in its consolidated statements of operations.

During the fourth quarter of 2008, the Company changed its accounting for changes in the fair value of

investments in the Sigma Fund. Prior to the fourth quarter of 2008, the Company distinguished between declines

it considered temporary and declines it considered permanent. When it became probable that the Company would

not collect all amounts it was owed on a security according to its contractual terms, the Company considered the

security to be impaired and recorded the permanent decline in fair value in earnings. During 2008, the Company

recorded $186 million of permanent impairments of Sigma Fund investments in the consolidated statement of

operations. Beginning in the fourth quarter of 2008, the Company began recording all changes in the fair value of

investments in the Sigma Fund in the consolidated statements of operations. In its stand-alone financial

statements, the Sigma Fund uses ‘‘investment company’’ accounting practices and records all changes in the fair

value of the underlying investments in earnings, whether such changes are considered temporary or permanent.

The Company determined the underlying accounting practices of the Sigma Fund in its stand-alone financial

statements should be retained in the Company’s consolidated financial statements. Accordingly, the Company

recorded the cumulative loss of $101 million on investments in the Sigma Fund investments in its consolidated

statement of operations during the fourth quarter of 2008. The Company determined amounts that arose in

periods prior to the fourth quarter of 2008 were not material to the consolidated results of operations in those

periods.

Securities with a significant temporary unrealized loss and a maturity greater than 12 months and defaulted

securities have been classified as non-current in the Company’s consolidated balance sheets. At December 31,

2009, $66 million of the Sigma Fund investments were classified as non-current, and the weighted average

maturity of the Sigma Fund investments classified as non-current (excluding defaulted securities) was 24 months.

At December 31, 2008, $466 million of the Sigma Fund investments were classified as non-current, and the

weighted average maturity of the Sigma Fund investments classified as non-current (excluding defaulted securities)

was 16 months.