Motorola 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

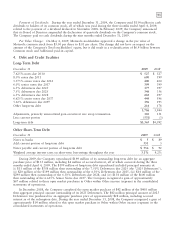

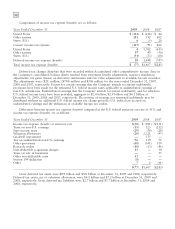

The following table shows the five largest net notional amounts of the positions to buy or sell foreign

currency as of December 31, 2009 and the corresponding positions as of December 31, 2008:

Notional Amount

December 31, December 31,

Net Buy (Sell) by Currency 2009 2008

Euro $(377) $(445)

Brazilian Real (342) (356)

Chinese Renminbi (297) (481)

Japanese Yen (236) 111

British Pound 143 122

The Company did not have any fair value hedge activity during 2009. For the year ended December 31,

2009, income representing the ineffective portions of changes in the fair value of cash flow hedge positions was

de minimus compared to expense of $2 million and income of $1 million for the years ended December 31, 2008

and 2007, respectively. These amounts are included in Other within Other income (expense) in the Company’s

consolidated statements of operations. The above amounts include the change in the fair value of derivative

contracts related to the changes in the difference between the spot price and the forward price. These amounts

are excluded from the measure of effectiveness. Expense (income) related to cash flow hedges that were

discontinued for the years ended December 31, 2009, 2008 and 2007 are included in the amounts noted above.

During the years ended December 31, 2009, 2008 and 2007, on a pre-tax basis, income (expense) of $(18)

million, $3 million and $(16) million, respectively, was reclassified from equity to earnings in the Company’s

consolidated statements of operations.

At December 31, 2009, the maximum term of derivative instruments that hedge forecasted transactions was

13 months. The weighted average duration of the Company’s derivative instruments that hedge forecasted

transactions was six months.

Interest Rate Risk

At December 31, 2009, the Company’s short-term debt consisted primarily of $5 million of short-term

variable rate foreign debt. The Company has $3.9 billion of long-term debt, including the current portion of

long-term debt, which is primarily priced at long-term, fixed interest rates.

As part of its liability management program, the Company historically entered into interest rate swaps (‘‘Hedging

Agreements’’) to synthetically modify the characteristics of interest rate payments for certain of its outstanding

long-term debt from fixed-rate payments to short-term variable rate payments. During the fourth quarter of 2008, the

Company terminated all of its Hedging Agreements. The termination of the Hedging Agreements resulted in cash

proceeds of approximately $158 million and a gain of approximately $173 million, which has been deferred and will

be recognized as a reduction of interest expense over the remaining term of the associated debt.

Prior to the termination of the Hedging Agreements in the fourth quarter of 2008, the Hedging Agreements

were designated as part of fair value hedging relationships of the Company’s long-term debt. As such, the changes

in fair value of the Hedging Agreements and corresponding adjustments to the carrying amount of the debt were

recognized in earnings. Interest expense on the debt was adjusted to include payments made or received under

such Hedging Agreements. During 2008 (prior to the Hedging Agreements being terminated) the Company

recognized expense of $1 million, representing the ineffective portion of changes in the fair value of the Hedging

Agreements. This amount is included in Other within Other income (expense) in the Company’s consolidated

statement of operations.

Certain of the terminated Hedging Agreements were originally entered into during the fourth quarter of

2007. The Company entered into the Hedging Agreements concurrently with the issuance of long-term debt to

convert the fixed rate interest cost on the newly issued debt to a floating rate. The Hedging Agreements were

originally designated as fair value hedges of the underlying debt, including the Company’s credit spread. During

the first quarter of 2008, the swaps were no longer considered effective hedges because of the volatility in the

price of the Company’s fixed-rate domestic term debt and the swaps were dedesignated. In the same period, the

Company was able to redesignate the same Hedging Agreements as fair value hedges of the underlying debt,

exclusive of the Company’s credit spread. For the period of time that the Hedging Agreements were deemed

ineffective hedges, the Company recognized a gain of $24 million in the Company’s consolidated statements of

operations, representing the increase in the fair value of the Hedging Agreements.