Motorola 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Indemnification Provisions: In addition, the Company may provide indemnifications for losses that result

from the breach of general warranties contained in certain commercial, intellectual property and divestiture

agreements. Historically, the Company has not made significant payments under these agreements, nor have there

been significant claims asserted against the Company. However, there is an increasing risk in relation to

intellectual property indemnities given the current legal climate. In indemnification cases, payment by the

Company is conditioned on the other party making a claim pursuant to the procedures specified in the particular

contract, which procedures typically allow the Company to challenge the other party’s claims. Further, the

Company’s obligations under these agreements for indemnification based on breach of representations and

warranties are generally limited in terms of duration, typically not more than 24 months, and for amounts not in

excess of the contract value, and in some instances the Company may have recourse against third parties for

certain payments made by the Company.

Legal Matters: The Company is a defendant in various lawsuits, claims and actions, which arise in the

normal course of business. In the opinion of management, the ultimate disposition of these matters will not have

a material adverse effect on the Company’s consolidated financial position, liquidity or results of operations.

Segment Information

The following commentary should be read in conjunction with the financial results of each operating

business segment as detailed in Note 12, ‘‘Information by Segment and Geographic Region,’’ to the Company’s

consolidated financial statements. Net sales and operating results for the Company’s three operating business

segments for 2009, 2008 and 2007 are presented below.

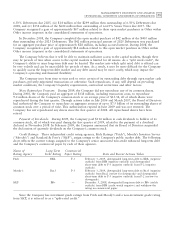

Mobile Devices Segment

The Mobile Devices segment designs, manufactures, sells and services wireless handsets, including

smartphones, with integrated software and accessory products, and licenses intellectual property. In 2009, the

segment’s net sales represented 32% of the Company’s consolidated net sales, compared to 40% in 2008 and

52% in 2007.

Years Ended December 31 Percent Change

(Dollars in millions) 2009 2008 2007 2009—2008 2008—2007

Segment net sales $ 7,146 $12,099 $18,988 (41)% (36)%

Operating earnings (loss) (1,077) (2,199) (1,201) (51)% 83%

Segment Results—2009 Compared to 2008

In 2009, the segment’s net sales were $7.1 billion, a decrease of 41% compared to net sales of $12.1 billion

in 2008. The 41% decrease in net sales was primarily driven by a 45% decrease in unit shipments, partially offset

by an 8% increase in average selling price (‘‘ASP’’). The segment’s net sales were negatively impacted by reduced

product offerings in large market segments, particularly 3G products, including smartphones, and the segment’s

limited product offerings in very low-tier products. On a product technology basis, net sales decreased

substantially for GSM, CDMA and 3G technologies, partially offset by an increase in net sales for iDEN

technology. On a geographic basis, net sales decreased substantially in Latin America, the Europe, Middle East

and African region (‘‘EMEA’’) and Asia and, to a lesser extent, decreased in North America.

The segment incurred an operating loss of $1.1 billion in 2009, an improvement of 51% compared to an

operating loss of $2.2 billion in 2008. The decrease in the operating loss was primarily due to decreases in:

(i) selling, general and administrative (‘‘SG&A’’) expenses, primarily due to lower marketing expenses and savings

from cost-reduction initiatives, (ii) research and development (‘‘R&D’’) expenditures, reflecting savings from

cost-reduction initiatives, (iii) lower excess inventory and other related charges in 2009 than in 2008, when the

charges included a $370 million charge due to a decision to consolidate software and silicon platforms, and

(iv) the absence in 2009 of a comparable $150 million charge in 2008 related to settlement of a purchase

commitment, partially offset by a decrease in gross margin, driven by the 41% decrease in net sales. As a

percentage of net sales in 2009 as compared to 2008, gross margin and R&D expenditures increased and SG&A

expenses decreased.

The segment’s industry typically experiences short life cycles for new products. Therefore, it is vital to the

segment’s success that new, compelling products are continually introduced. Accordingly, a strong commitment to