Motorola 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

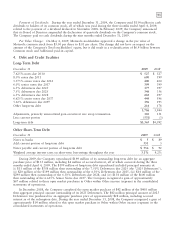

Other Income (Expense)

Interest income, net, and Other both included in Other income (expense) consist of the following:

Years Ended December 31 2009 2008 2007

Interest income, net:

Interest expense $(213) $(224) $(365)

Interest income 81 272 456

$(132) $48 $91

Other:

Gain (loss) on Sigma Fund investments $80 $(101) $ —

Gain from the extinguishment of the Company’s outstanding long-term debt 67 14 —

Investment impairments (77) (365) (44)

Foreign currency gain (loss) (52) (84) 97

Impairment charges on Sigma Fund investments —(186) (18)

U.S. pension plan freeze curtailment gain —237 —

Liability extinguishment gain —56 —

Gain on interest rate swaps —24 —

Other 933 1

$27 $(372) $ 36

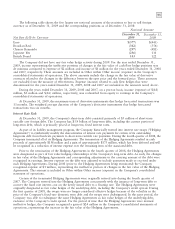

Loss Per Common Share

Basic and diluted loss per common share from both continuing operations and net loss attributable to

Motorola, Inc., including discontinued operations, is computed as follows:

Net Loss attributable to

Continuing Operations Motorola, Inc.

Years Ended December 31 2009 2008 2007 2009 2008 2007

Basic loss per common share:

Loss $ (111) $ (4,244) $ (105) $ (51) $ (4,244) $ (49)

Weighted average common shares

outstanding 2,295.6 2,265.4 2,312.7 2,295.6 2,265.4 2,312.7

Per share amount $ (0.05) $ (1.87) $ (0.05) $ (0.02) $ (1.87) $ (0.02)

Diluted loss per common share:

Loss $ (111) $ (4,244) $ (105) $ (51) $ (4,244) $ (49)

Diluted weighted average common shares

outstanding 2,295.6 2,265.4 2,312.7 2,295.6 2,265.4 2,312.7

Per share amount $ (0.05) $ (1.87) $ (0.05) $ (0.02) $ (1.87) $ (0.02)

For the years ended December 31, 2009, 2008 and 2007, the Company was in a net loss position and,

accordingly, the basic and diluted weighted average shares outstanding are equal because any increase to the basic

shares would be antidilutive. In the computation of diluted loss per common share from both continuing

operations and on a net loss basis for the years ended December 31, 2009, 2008, and 2007, the assumed exercise

of 176.4 million, 218.5 million and 209.6 million stock options, respectively, were excluded because their

inclusion would have been antidilutive. In the computation of diluted loss per common share from both

continuing operations and on a net loss basis for the years ended December 31, 2009, 2008 and 2007,

56.3 million, 32.6 million and 9.8 million restricted stock and restricted stock units, respectively, were excluded

because their inclusion would have been antidilutive.