Motorola 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

Netopia, Inc.

In February 2007, the Company acquired Netopia, Inc. (‘‘Netopia’’), a broadband equipment provider for

DSL customers, which allows for phone, TV and fast Internet connections, for $183 million in net cash. The

Company recorded $61 million in goodwill, none of which was expected to be deductible for tax purposes, and

$100 million in identifiable intangible assets. Intangible assets are included in Other assets in the Company’s

consolidated balance sheets. The intangible assets are being amortized over a period of 7 years on a straight-line

basis.

The results of operations of Netopia have been included in the Home and Networks Mobility segment in the

Company’s consolidated financial statements subsequent to the date of acquisition. The pro forma effects of this

acquisition on the Company’s consolidated financial statements were not significant.

Terayon Communication Systems, Inc.

In July 2007, the Company acquired Terayon Communication Systems, Inc. (‘‘Terayon’’), a provider of

real-time digital video networking applications to cable, satellite and telecommunication service providers

worldwide, for $137 million in net cash. The Company recorded $21 million in goodwill, none of which is

expected to be deductible for tax purposes, and $52 million in identifiable intangible assets. Intangible assets are

included in Other assets in the Company’s consolidated balance sheets. The intangible assets are being amortized

over periods ranging from 4 to 6 years on a straight-line basis.

The results of operations of Terayon have been included in the Home and Networks Mobility segment in the

Company’s consolidated financial statements subsequent to the date of acquisition. The pro forma effects of this

acquisition on the Company’s consolidated financial statements were not significant.

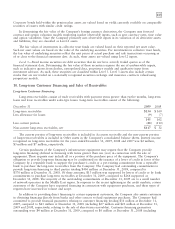

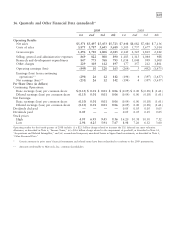

Intangible Assets

Amortized intangible assets were comprised of the following:

2009 2008

Gross Gross

Carrying Accumulated Carrying Accumulated

December 31 Amount Amortization Amount Amortization

Intangible assets:

Completed technology $1,123 $ 792 $1,127 $ 633

Patents 288 179 292 125

Customer-related 278 145 277 104

Licensed technology 130 122 129 118

Other intangibles 149 137 150 126

$1,968 $1,375 $1,975 $1,106

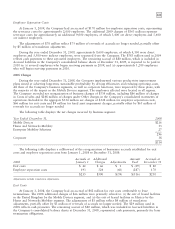

Amortization expense on intangible assets, which is included within Other charges in the consolidated

statement of operations, was $278 million, $318 million and $369 million for the years ended December 31,

2009, 2008 and 2007, respectively. As of December 31, 2008 future amortization expense is estimated to be

$257 million in 2010, $243 million in 2011, $50 million in 2012 and $29 million in 2013 and $9 million in

2014.