Motorola 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

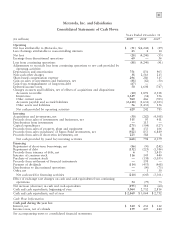

81

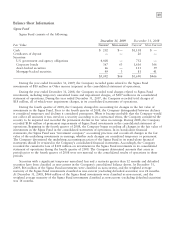

Motorola, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

Years Ended December 31

(In millions) 2009 2008 2007

Operating

Net loss attributable to Motorola, Inc. $ (51) $(4,244) $ (49)

Less: Earnings attributable to noncontrolling interests 23 414

Net loss (28) (4,240) (35)

Earnings from discontinued operations 60 —56

Loss from continuing operations (88) (4,240) (91)

Adjustments to reconcile loss from continuing operations to net cash provided by

operating activities:

Depreciation and amortization 751 831 903

Non-cash other charges 38 2,516 213

Share-based compensation expense 296 280 315

Gain on sales of investments and businesses, net (88) (82) (50)

Gain from extinguishment of long-term debt (67) ——

Deferred income taxes 50 1,698 (747)

Changes in assets and liabilities, net of effects of acquisitions and dispositions:

Accounts receivable (10) 1,891 2,538

Inventories 1,349 (54) 556

Other current assets 960 466 (705)

Accounts payable and accrued liabilities (2,618) (1,631) (2,303)

Other assets and liabilities 56 (1,433) 156

Net cash provided by operating activities 629 242 785

Investing

Acquisitions and investments, net (50) (282) (4,568)

Proceeds from sales of investments and businesses, net 315 93 411

Distributions from investments —113 —

Capital expenditures (275) (504) (527)

Proceeds from sales of property, plant and equipment 41 133 166

Proceeds from sales (purchases) of Sigma Fund investments, net (922) 853 6,889

Proceeds from sales of short-term investments, net 223 388 8

Net cash provided by (used for) investing activities (668) 794 2,379

Financing

Repayment of short-term borrowings, net (86) (50) (242)

Repayment of debt (132) (225) (1,386)

Proceeds from issuance of debt, net 67 1,415

Issuance of common stock 116 145 440

Purchase of common stock —(138) (3,035)

Proceeds from settlement of financial instruments —158 —

Payment of dividends (114) (453) (468)

Distributions to discontinued operations —(90) (75)

Other, net —150

Net cash used for financing activities (210) (645) (3,301)

Effect of exchange rate changes on cash and cash equivalents from continuing

operations 54 (79) 73

Net increase (decrease) in cash and cash equivalents (195) 312 (64)

Cash and cash equivalents, beginning of year 3,064 2,752 2,816

Cash and cash equivalents, end of year $ 2,869 $ 3,064 $ 2,752

Cash Flow Information

Cash paid during the year for:

Interest, net $ 320 $ 252 $ 312

Income taxes, net of refunds 159 407 440

See accompanying notes to consolidated financial statements.