Motorola 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

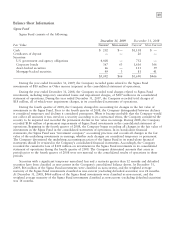

Other Assets

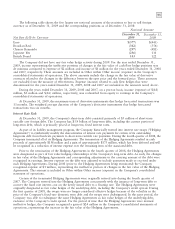

Other assets consists of the following:

December 31 2009 2008

Intangible assets, net of accumulated amortization of $1,375 and $1,106 $ 593 $ 869

Contract related deferred costs 345 136

Royalty license arrangements 255 289

Value-added tax refunds receivable 127 117

Long-term receivables, net of allowances of $9 and $7 117 52

Other 348 353

$1,785 $1,816

Accrued Liabilities

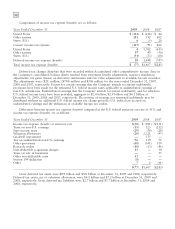

Accrued liabilities consists of the following:

December 31 2009 2008

Deferred revenue $1,325 $1,533

Compensation 634 703

Customer reserves 424 599

Billings in excess of costs and earnings 336 210

Tax liabilities 258 545

Customer downpayments 178 496

Contractor payables 240 318

Warranty reserves 226 285

Other 1,675 2,651

$5,296 $7,340

Other Liabilities

Other liabilities consists of the following:

December 31 2009 2008

Defined benefit plans, including split dollar life insurance policies $2,450 $2,202

Deferred revenue 713 316

Postretirement health care benefit plan 287 261

Unrecognized tax benefits 196 312

Other 448 471

$4,094 $3,562

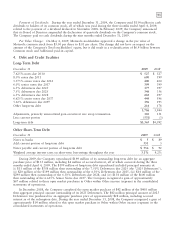

Stockholders’ Equity Information

Share Repurchase Program: During the year ended December 31, 2009, the Company did not repurchase

any of its common shares. During the year ended December 31, 2008, the Company repurchased 9.0 million of

its common shares at an aggregate cost of $138 million, or an average cost of $15.32 per share, all of which

were repurchased during the three months ended March 29, 2008. During the year ended December 31, 2007,

the Company repurchased 171.2 million of its common shares at an aggregate cost of $3.0 billion, or an average

cost of $17.74 per share.

Through actions taken in July 2006 and March 2007, the Board of Directors had authorized the Company

to repurchase an aggregate amount of up to $7.5 billion of its outstanding shares of common stock over a period

of time. This authorization expired in June 2009 and was not renewed. The Company has not repurchased any

shares since the first quarter of 2008. All repurchased shares have been retired.