Motorola 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

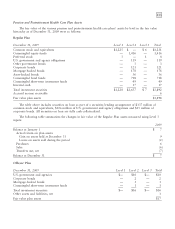

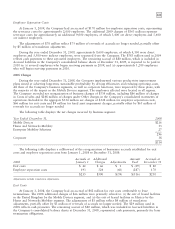

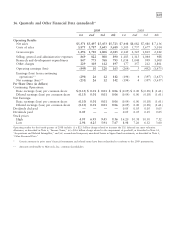

The Operating loss in Other and Eliminations consists of the following:

Years Ended December 31 2009 2008 2007

Amortization of intangible assets $278 $ 318 $ 369

Share-based compensation expense 206 224 284

Corporate expenses 181 252 240

Separation-related transaction costs 42 59 —

Reorganization of business charges 30 38 64

Environmental reserve charge 24 ——

Legal settlements, net (75) 14 140

Goodwill impairment —1,619 —

Asset impairments —129 81

In-process research and development charges —196

Gain on sale of property, plant and equipment —(48) —

$686 $2,606 $1,274

Share-based compensation expense is primarily comprised of: (i) compensation expense related to the Company’s employee stock options,

stock appreciation rights and employee stock purchase plans, and (ii) compensation expenses related to the restricted stock and restricted

stock units granted to the corporate employees.

Corporate expense are primarily comprised of: (i) general corporate-related expenses, (ii) various corporate programs, representing

developmental businesses and research and development projects, which are not included in any reporting segment, and (iii) the Company’s

wholly-owned finance subsidiary.

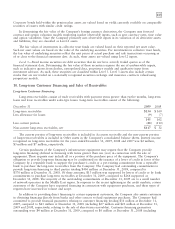

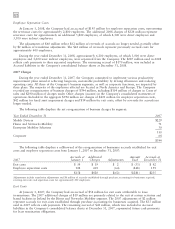

Assets Capital Expenditures Depreciation Expense

Years Ended December 31 2009 2008 2007 2009 2008 2007 2009 2008 2007

Mobile Devices $ 2,589 $ 3,559 $ 6,325 $35 $ 84 $132 $104 $115 $146

Home and Networks Mobility 5,861 7,024 7,451 85 147 160 130 135 141

Enterprise Mobility Solutions 5,559 6,000 8,694 141 166 113 152 158 167

14,009 16,583 22,470 261 397 405 386 408 454

Other and Eliminations 11,594 11,286 12,342 14 107 122 85 103 83

$25,603 $27,869 $34,812 $275 $504 $527 $471 $511 $537

Assets in Other include primarily cash and cash equivalents, Sigma Fund, deferred income taxes, short-term investments, property, plant and

equipment, investments, and the administrative headquarters of the Company.

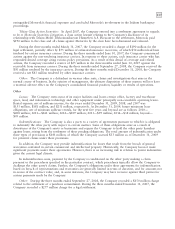

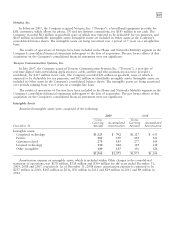

Geographic area information

Property, Plant, and

Net Sales Assets Equipment, net

Years Ended December 31 2009 2008 2007 2009 2008 2007 2009 2008 2007

United States $11,834 $14,708 $18,548 $18,480 $17,938 $22,385 $1,050 $1,240 $1,252

China 1,393 2,011 2,632 2,785 3,307 3,926 252 294 311

Brazil 910 1,554 1,671 860 1,057 1,440 100 110 109

United Kingdom 579 936 1,070 1,317 1,314 1,305 48 85 121

Israel 531 696 741 1,330 1,268 1,374 173 141 165

Singapore 93 116 128 720 1,875 3,120 20 32 40

Other nations, net of

eliminations 6,704 10,125 11,832 111 1,110 1,262 511 540 482

$22,044 $30,146 $36,622 $25,603 $27,869 $34,812 $2,154 $2,442 $2,480

Net sales by geographic region are measured by the locale of end customer.

13. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the ‘‘Severance Plan’’), which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in