Motorola 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

the world, including those in the U.S., Japan, China and the Middle East and Africa region. We expect the overall

2G and 3G wireless infrastructure market to decline in 2010 compared to 2009 and to remain highly competitive.

In the Home and Networks Mobility segment, we will continue to optimize our overall cost structure while

prioritizing investments in next-generation technologies commensurate with opportunities for profitable growth.

This positions the business for future opportunities in emerging technologies, including video and wireline and

wireless broadband, and enables the business to maintain profitability in mature technologies.

In our Enterprise Mobility Solutions business, we have market leading positions in both mission-critical and

business-critical communications solutions for customers around the world. We continue to develop

next-generation products and solutions for customers in our government and public safety and commercial

enterprise markets. Many U.S. states and local governments are facing budget deficits in 2010 and some states

may be required to significantly curtail spending. Additionally, many governments outside the U.S. are facing

budget deficits. We believe that these customers will continue to place a high priority on mission-critical

communications and homeland security products and solutions. In 2009, while we experienced relatively stable

levels of demand from these customers, continued budget constraints, especially in the U.S. market, could impact

the timing and volume of purchases in 2010. Our research and development focus continues to be on delivering

innovative products and solutions that meet our customers’ needs, such as our industry leading APXTM two-way

radio communications systems. These systems have multi-band functionality that provides interoperability across

various communication systems, reducing the number of devices our customers carry and enhancing

communications efficiency.

The focus for customers in our commercial enterprise market includes converged communication and

computing products that increase worker mobility and productivity, as well as enhanced end-user experiences.

During 2009, many of these customers faced challenging economic conditions. These conditions have largely

stabilized in recent months. Due to the postponement of capital purchases in 2009, we believe many of our

customers will upgrade their technology in 2010 to improve supply-chain efficiencies, increase productivity of

associates and improve end-customer buying experiences.

We believe that our comprehensive portfolio of products and solutions and market leadership make our

Enterprise Mobility Solutions business well positioned for profitable growth as economic conditions across our

markets improve.

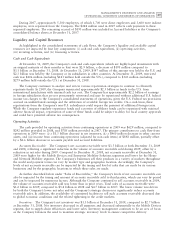

In 2009, we implemented a number of global actions across the Company to significantly reduce its cost

structure. To ensure alignment with market conditions, we will continually review our cost structure as we

aggressively manage costs while maintaining investments focused on innovation and future growth opportunities.

We remain very focused on the strength of our balance sheet and our overall liquidity position. We believe

we have more than sufficient liquidity to operate our business.

We conduct our business in highly competitive markets, facing both new and established competitors. The

markets for many of our products are characterized by rapidly changing technologies, frequent new product

introductions, changing consumer trends, short product life cycles and evolving industry standards. Market

disruptions caused by new technologies, the entry of new competitors, and consolidations among our customers

and competitors, among other matters, can introduce volatility into our businesses. We face challenging, but

stabilizing, global economic conditions with more limited visibility than historical norms. Meeting all of these

challenges requires consistent operational planning and execution and investment in technology, resulting in

innovative products that meet the needs of our customers around the world. As we execute on meeting these

objectives, we remain focused on taking the necessary action to design and deliver differentiated and innovative

products and services that will advance the way the world connects by simplifying and personalizing

communications and enhancing mobility.

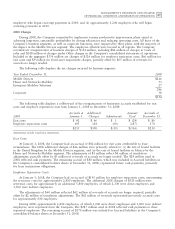

What is the status of our plan to separate into two independent, publicly traded companies?

In March 2008, the Company announced that it was pursuing the creation of two independent, publicly

traded companies. On February 11, 2010, the Company announced that it is now targeting the first quarter of

2011 for the completion of this planned separation. The Company currently expects that, upon separation, one

public company will be comprised of the Company’s Mobile Devices and Home businesses and the other public

company will be comprised of the Company’s Enterprise Mobility Solutions and Networks businesses.

The Company intends to effect the separation through a tax-free pro rata stock dividend of shares in the new

company to Motorola shareholders. Following the separation, the Company intends that both businesses will be

well capitalized so that each of the companies can execute their respective business plans and be able to address

future opportunities. The Company expects that, post-separation, the Enterprise Mobility and Networks business