Motorola 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

the event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. Effective

August 1, 2009, the Company amended and restated the Severance Plan. Under the amended Severance Plan,

severance benefits will be paid in bi-weekly installments to impacted employees rather than in lump sum

payments. The Company recognizes termination benefits based on formulas per the Severance Plan at the point in

time that future settlement is probable and can be reasonably estimated based on estimates prepared at the time a

restructuring plan is approved by management. Exit costs consist of future minimum lease payments on vacated

facilities and other contractual terminations. At each reporting date, the Company evaluates its accruals for

employee separation and exit costs to ensure the accruals are still appropriate. In certain circumstances, accruals

are no longer needed because of efficiencies in carrying out the plans or because employees previously identified

for separation resigned from the Company and did not receive severance or were redeployed due to circumstances

not foreseen when the original plans were initiated. In these cases, the Company reverses accruals through the

consolidated statements of operations where the original charges were recorded when it is determined they are no

longer needed.

2009 Charges

During the year ended December 31, 2009, in light of the macroeconomic decline that adversely affected

sales, the Company continued to implement various productivity improvement plans aimed at achieving

long-term, sustainable profitability by driving efficiencies and reducing operating costs. All three of the

Company’s business segments, as well as corporate functions, are impacted by these plans, with the majority of

the impact in the Mobile Devices segment. The employees affected are located in all geographic regions.

During the year ended December 31, 2009, the Company recorded net reorganization of business charges of

$336 million, including $78 million of charges in Costs of sales and $258 million of charges under Other charges

in the Company’s consolidated statements of operations. Included in the aggregate $336 million are charges of

$363 million for employee separation costs, $36 million for exit costs and $20 million for fixed asset impairment

charges, partially offset by $83 million of reversals for accruals no longer needed.

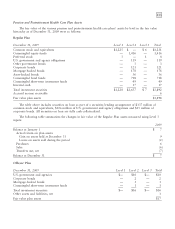

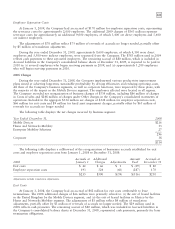

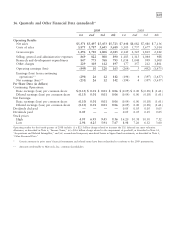

The following table displays the net charges incurred by business segment:

Year Ended December 31 2009

Mobile Devices $184

Home and Networks Mobility 52

Enterprise Mobility Solutions 70

306

Corporate 30

$336

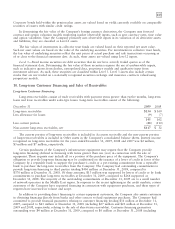

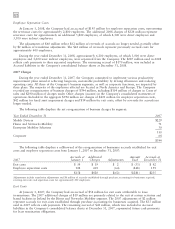

The following table displays a rollforward of the reorganization of businesses accruals established for exit

costs and employee separation costs from January 1, 2009 to December 31, 2009:

Accruals at Additional Amount Accruals at

2009 January 1 Charges Adjustments Used December 31

Exit costs $ 80 $ 36 $ (9) $ (49) $ 58

Employee separation costs 170 363 (70) (383) 80

$250 $399 $(79) $(432) $138

Adjustments include translation adjustments.

Exit Costs

At January 1, 2009, the Company had an accrual of $80 million for exit costs attributable to lease

terminations. The additional 2009 charges of $36 million are primarily related to the exit of leased facilities and

contractual termination costs. The adjustments of $9 million reflect: (i) $8 million of reversals of accruals no

longer needed, and (ii) $1 million of translation adjustments. The $49 million used in 2009 reflects cash

payments. The remaining accrual of $58 million, which is included in Accrued liabilities in the Company’s

consolidated balance sheets at December 31, 2009, represents future cash payments, primarily for lease

termination obligations.