Motorola 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Additionally, one of the Company’s European subsidiaries has outstanding interest rate agreements (‘‘Interest

Agreements’’) relating to a Euro-denominated loan. The interest on the Euro-denominated loan is variable. The

Interest Agreements change the characteristics of interest rate payments from variable to maximum fixed-rate

payments. The Interest Agreements are not accounted for as a part of a hedging relationship and, accordingly, the

changes in the fair value of the Interest Agreements are included in Other income (expense) in the Company’s

consolidated statements of operations. During the second quarter of 2009, the Company’s European subsidiary

terminated a portion of the Interest Agreements to ensure that the notional amount of the Interest Agreements

matched the amount outstanding under the Euro-denominated loan. The termination of the Interest Agreements

resulted in an expense of approximately $2 million. The weighted average fixed rate payments on these Interest

Agreements was 5.34%. The fair value of the Interest Agreements at December 31, 2009 and December 31, 2008

were $(4) million and $(2) million, respectively.

Counterparty Risk

The use of derivative financial instruments exposes the Company to counterparty credit risk in the event of

nonperformance by counterparties. However, the Company’s risk is limited to the fair value of the instruments

when the derivative is in an asset position. The Company actively monitors its exposure to credit risk. At present

time, all of the counterparties have investment grade credit ratings. The Company is not exposed to material

credit risk with any single counterparty. As of December 31, 2009, the Company was exposed to an aggregate

credit risk of $8 million with all counterparties.

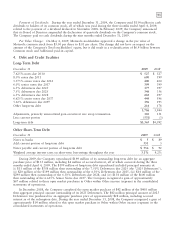

The following table summarizes the fair values and location in our consolidated balance sheet of all

derivative financial instruments held by the Company:

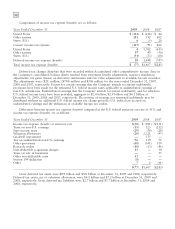

Fair Values of Derivative Instruments

Assets Liabilities

Balance Balance

Fair Sheet Fair Sheet

December 31, 2009 Value Location Value Location

Derivatives designated as hedging instruments:

Foreign exchange contracts $ 5 Other assets $ 1 Other liabilities

Derivatives not designated as hedging instruments:

Foreign exchange contracts 10 Other assets 16 Other liabilities

Interest agreement contracts — Other assets 4 Other liabilities

Total derivatives not designated as hedging instruments 10 20

Total derivatives $15 $21

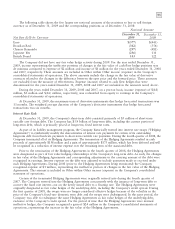

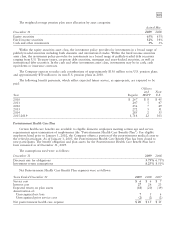

The following table summarizes the effect of derivative instruments in our consolidated statements of

operations:

Loss on the Derivative Statement of

Year Ended December 31, 2009 Instrument Operations Location

Derivatives designated as hedging instruments:

Foreign exchange contracts $ — Foreign currency income (expense)

Derivatives not designated as hedging instruments:

Interest rate contracts (16) Other income (expense)

Foreign exchange contracts (166) Other income (expense)

Total derivatives not designated as hedging

instruments $(182)