Motorola 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

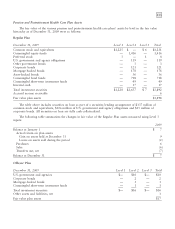

$2 million and $4 million at December 31, 2009 and 2008, respectively, relating to the sale of short-term

receivables).

Sales of Receivables

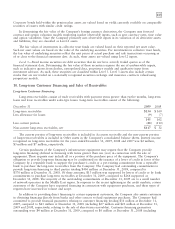

From time to time, the Company sells accounts receivable and long-term receivables in transactions that

qualify as ‘‘true-sales.’’ Certain of these accounts receivable and long-term receivables are sold to third parties on

a one-time, non-recourse basis, while others are sold to third parties under committed facilities that involve

contractual commitments from these parties to purchase qualifying receivables up to an outstanding monetary

limit. Committed facilities may be revolving in nature and, typically, must be renewed annually. The Company

may or may not retain the obligation to service the sold accounts receivable and long-term receivables.

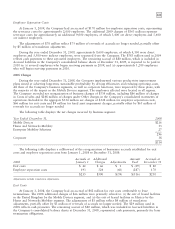

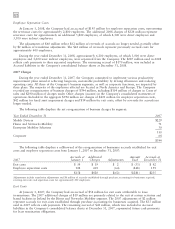

At December 31, 2009, the Company had $200 million of committed revolving facilities for the sale of

accounts receivable, of which $60 million was utilized. At December 31, 2008 and 2007, the Company had

$532 million and $1.4 billion, respectively, of committed revolving facilities for the sale of accounts receivable, of

which $497 and $817 million, respectively, were utilized. In addition, as of December 31, 2008, the Company

had $435 million of committed facilities associated with the sale of long-term financing receivables primarily for a

single customer, of which $262 million was utilized. At December 31, 2009, the Company had no significant

committed facilities for the sale of long-term receivables. During the first quarter of 2009, a $400 million

committed accounts receivable facility expired and was not renewed. During the second quarter of 2009, a

$132 million committed accounts receivable facility was terminated. In June 2009, the Company initiated a new

$200 million committed revolving domestic accounts receivable facility.

In 2009, the Company made a strategic decision to significantly reduce its volume of accounts receivables

sold.

Total sales of accounts receivable and long-term receivables were $1.3 billion for the year ended

December 31, 2009 (including $1.2 billion of sales of accounts receivable), compared to $3.7 billion for the year

ended December 31, 2008 (including $3.4 billion of sales of accounts receivable) and $4.9 billion for the year

ended December 31, 2007 (including $4.7 billion of sales of accounts receivable). At December 31, 2009, the

Company retained servicing obligations for $195 million of sold accounts receivables and $297 million of

long-term receivables, compared to $621 million of accounts receivables and $400 million of long-term

receivables at December, 31, 2008.

Under certain arrangements, the value of accounts receivable sold is covered by credit insurance purchased

from third-party insurance companies, less deductibles or self-insurance requirements under the insurance policies.

The Company’s total credit exposure, less insurance coverage, to outstanding accounts receivables that have been

sold was $27 million and $23 million at December 31, 2009 and 2008, respectively.

11. Commitments and Contingencies

Legal

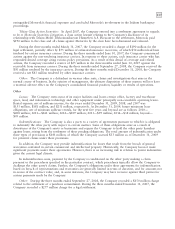

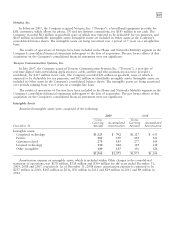

Iridium Program: The Company was named as one of several defendants in putative class action securities

lawsuits arising out of alleged misrepresentations or omissions regarding the Iridium satellite communications

business which, on March 15, 2001, were consolidated in the federal district court in the District of Columbia

under Freeland v. Iridium World Communications, Inc., et al., originally filed on April 22, 1999. In April 2008,

the parties reached an agreement in principle, subject to court approval, to settle all claims against Motorola in

exchange for Motorola’s payment of $20 million. During the three months ended March 29, 2008, the Company

recorded a charge associated with this settlement. On October 23, 2008, the court granted final approval of the

settlement and dismissed the claims with prejudice.

The Company was sued by the Official Committee of the Unsecured Creditors of Iridium (the ‘‘Committee’’)

in the United States Bankruptcy Court for the Southern District of New York (the ‘‘Iridium Bankruptcy Court’’)

on July 19, 2001. In re Iridium Operating LLC, et al. v. Motorola, plaintiffs asserted claims for breach of

contract, warranty and fiduciary duty and fraudulent transfer and preferences, and sought in excess of $4 billion

in damages. On May 20, 2008, the Bankruptcy Court approved a settlement in which Motorola is not required

to pay anything, but released its administrative, priority and unsecured claims against the Iridium estate and

withdrew its objection to the 2001 settlement between the unsecured creditors of the Iridium Debtors and the

Iridium Debtors’ pre-petition secured lenders. This settlement, and its approval by the Bankruptcy Court,