Motorola 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

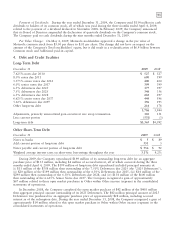

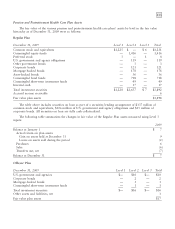

Non-U.S. Plans

Years Ended December 31 2009 2008 2007

Service cost $26 $34 $45

Interest cost 77 87 90

Expected return on plan assets (69) (84) (76)

Amortization of:

Unrecognized net loss 7114

Unrecognized prior service cost 11—

Settlement/curtailment gain (1) (7) —

Net periodic pension cost $41 $32 $73

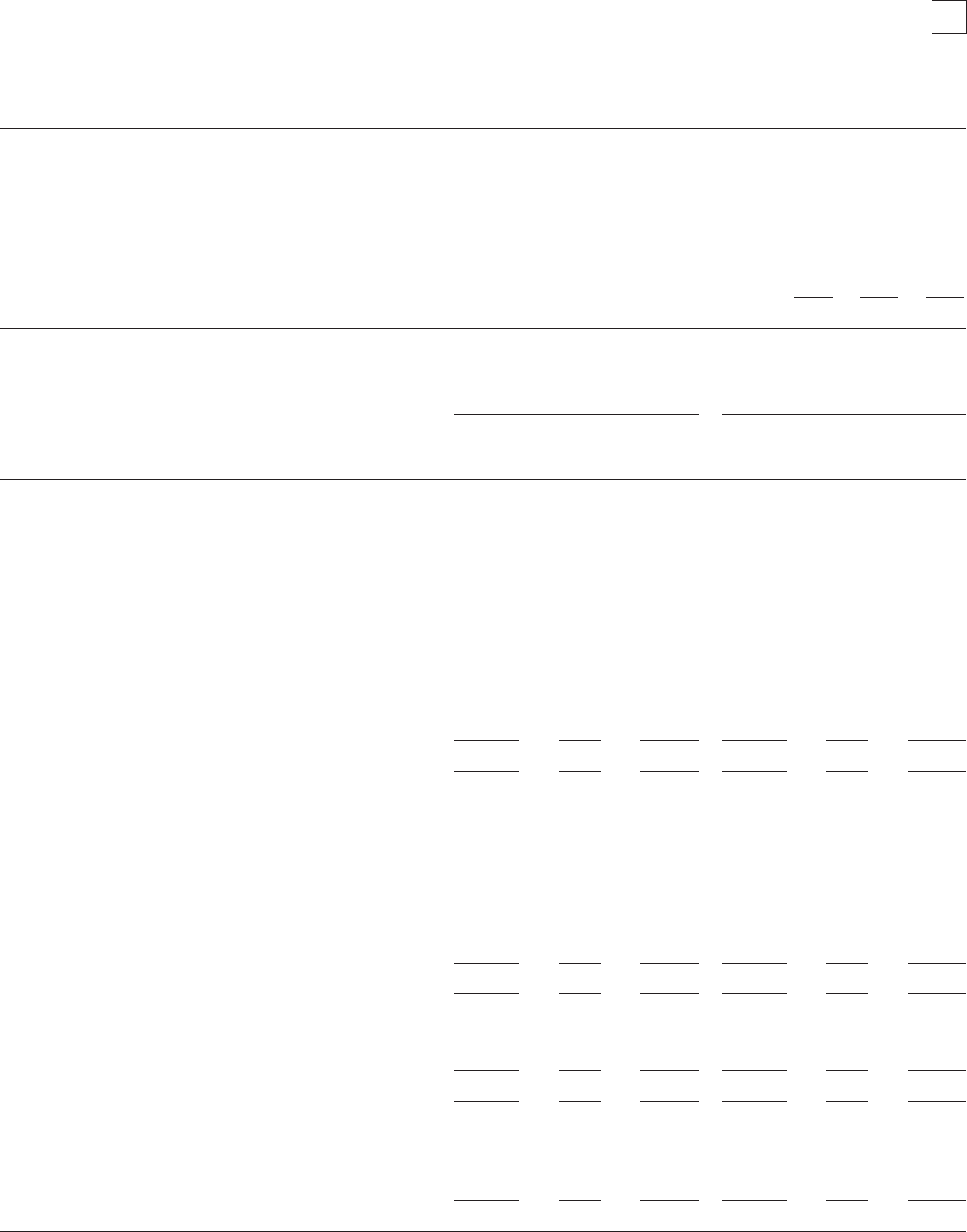

The status of the Company’s plans is as follows:

2009 2008

Officers’ Officers’

and Non and Non

Regular MSPP U.S. Regular MSPP U.S.

Change in benefit obligation:

Benefit obligation at January 1 $ 5,110 $116 $1,221 $ 4,879 $118 $1,689

Service cost 14 — 26 98 3 34

Interest cost 336 6 77 323 7 87

Plan amendments —— 2 —— 1

Settlement/curtailment — — (7) (168) (2) —

Actuarial (gain) loss 592 (20) 214 207 7 (149)

Foreign exchange valuation adjustment —— 87 — — (353)

Employee contributions —— 6 —— 6

Tax payments —(1) — —(1) —

Benefit payments (231) (49) (50) (229) (16) (94)

Benefit obligation at December 31 5,821 52 1,576 5,110 116 1,221

Change in plan assets:

Fair value at January 1 3,295 56 957 4,674 66 1,403

Return on plan assets 754 1 123 (1,390) 4 (107)

Company contributions 80 10 39 240 3 54

Employee contributions —— 6 —— 6

Foreign exchange valuation adjustment —— 72 — — (305)

Tax payments from plan assets —(1) — —(1) —

Benefit payments from plan assets (231) (49) (50) (229) (16) (94)

Fair value at December 31 3,898 17 1,147 3,295 56 957

Funded status of the plan (1,923) (35) (429) (1,815) (60) (264)

Unrecognized net loss 2,863 13 342 2,722 48 180

Unrecognized prior service cost —— 6 —— 4

Prepaid (accrued) pension cost $ 940 $ (22) $ (81) $ 907 $ (12) $ (80)

Components of prepaid (accrued) pension cost:

Non-current benefit liability $(1,923) $ (35) $ (429) $(1,815) $ (60) $ (264)

Deferred income taxes 1,062 6 24 1,008 19 14

Accumulated other comprehensive income (loss) 1,801 7 324 1,714 29 170

Prepaid (accrued) pension cost $ 940 $ (22) $ (81) $ 907 $ (12) $ (80)

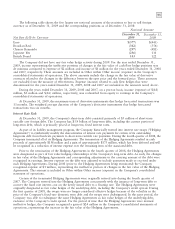

It is estimated that the net periodic cost for 2010 will include amortization of the unrecognized net loss and

prior service costs for the Regular Plan, Officers’ and MSPP Plans, and Non-U.S. Plans, currently included in

Accumulated other comprehensive income (loss), of $151 million, $2 million, and $15 million, respectively.