Motorola 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Credit Facilities

In June 2009, the Company elected to amend its domestic syndicated revolving credit facility (as amended

from time to time, the ‘‘Credit Facility’’) that is scheduled to mature in December 2011. In light of the

uncertainties in the macroeconomic environment and resulting capital market dislocations, the Company believed

it was prudent to restructure the Credit Facility to facilitate ongoing access to incremental liquidity. As part of the

amendment, the Company reduced the size of the Credit Facility to the lesser of: (i) $1.5 billion, or (ii) an

amount determined based on eligible domestic accounts receivable and inventory. If the Company elects to

borrow under the Credit Facility, only then and not before, it would be required to pledge its domestic accounts

receivables and, at its option, domestic inventory. As amended, the Credit Facility does not require the Company

to meet any financial covenants unless remaining availability under the Credit Facility is less than $225 million.

In addition, until borrowings are made under the Credit Facility, the Company is able to use its working capital

assets in any capacity in conjunction with other capital market funding alternatives that may be available to the

Company. The Company has never borrowed under this Credit Facility or predecessor syndicated revolving credit

facilities.

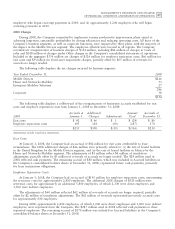

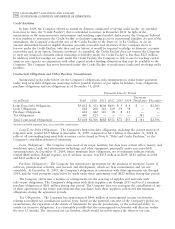

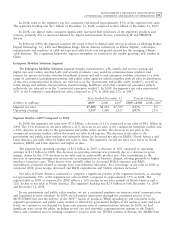

Contractual Obligations and Other Purchase Commitments

Summarized in the table below are the Company’s obligations and commitments to make future payments

under long-term debt obligations (assuming earliest possible exercise of put rights by holders), lease obligations,

purchase obligations and tax obligations as of December 31, 2009.

Payments Due by Period

Uncertain

(in millions) Total 2010 2011 2012 2013 2014 Timeframe Thereafter

Long-Term Debt Obligations $3,852 $ 531 $604 $405 $ 5 $ 4 $ — $2,303

Lease Obligations 668 208 161 109 59 38 — 93

Purchase Obligations 622 442 123 38 8 11 — —

Tax Obligations 466 125 — — — — 341 —

Total Contractual Obligations $5,608 $1,306 $888 $552 $72 $53 $ 341 $2,396

Amounts included represent firm, non-cancelable commitments.

Long-Term Debt Obligations: The Company’s long-term debt obligations, including the current portion of

long-term debt, totaled $3.9 billion at December 31, 2009, compared to $4.1 billion at December 31, 2008. A

table of all outstanding long-term debt securities can be found in Note 4, ‘‘Debt and Credit Facilities,’’ to the

Company’s consolidated financial statements.

Lease Obligations: The Company owns most of its major facilities, but does lease certain office, factory and

warehouse space, land, and information technology and other equipment, principally under non-cancelable

operating leases. At December 31, 2009, future minimum lease obligations, net of minimum sublease rentals,

totaled $668 million. Rental expense, net of sublease income, was $153 million in 2009, $181 million in 2008

and $231 million in 2007.

Purchase Obligations: The Company has entered into agreements for the purchase of inventory, license of

software, promotional activities, and research and development, which are firm commitments and are not

cancelable. At December 31, 2009, the Company’s obligations in connection with these agreements run through

2014, and the total payments expected to be made under these agreements total $622 million during that period.

The Company enters into a number of arrangements for the sourcing of supplies and materials with

take-or-pay obligations. The Company’s obligations with these suppliers run through 2013 and total a minimum

purchase obligation of $161 million during that period. The Company does not anticipate the cancellation of any

of these agreements in the future and estimates that purchases from these suppliers will exceed the minimum

obligations during the agreement periods.

Tax Obligations: The Company has approximately $466 million of unrecognized income tax benefits

relating to multiple tax jurisdictions and tax years. Based on the potential outcome of the Company’s global tax

examinations, the expiration of the statute of limitations for specific jurisdictions, or the continued ability to

satisfy tax incentive obligations, it is reasonably possible that the unrecognized tax benefits will decrease within

the next 12 months. The associated net tax benefits, which would favorably impact the effective tax rate,