Motorola 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

the improvement in cash flow from operations in 2009 were: (i) a $1.3 billion decrease in net inventory,

(ii) a $960 million decrease in other current assets, and (iii) income from continuing operations (adjusted

for non-cash items) of $892 million, partially offset by a $2.6 billion decrease in accounts payable and

accrued liabilities.

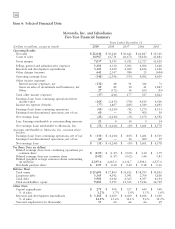

What were the financial results for our three operating business segments in 2009?

•In Our Mobile Devices Business: Net sales were $7.1 billion in 2009, a decrease of 41% compared to net

sales of $12.1 billion in 2008. The decrease in net sales was primarily driven by a 45% decrease in unit

shipments, partially offset by an 8% increase in average selling price (‘‘ASP’’). On a product technology

basis, net sales decreased substantially for GSM, CDMA and 3G technologies, partially offset by an

increase in net sales for iDEN technology. On a geographic basis, net sales decreased substantially in Latin

America, the Europe, Middle East and Africa region (‘‘EMEA’’) and Asia and, to a lesser extent, decreased

in North America.

The segment incurred an operating loss of $1.1 billion in 2009, an improvement of 51% compared to an

operating loss of $2.2 billion in 2008. The decrease in the operating loss was primarily due to: (i) lower

selling, general and administrative (‘‘SG&A’’) expenses, primarily due to lower marketing expenses and

savings from cost-reduction initiatives, (ii) lower research and development (‘‘R&D’’) expenditures,

reflecting savings from cost-reduction initiatives, (iii) lower excess inventory and other related charges in

2009 than in 2008, when the charges included a $370 million charge due to a decision to consolidate

software and silicon platforms, and (iv) the absence in 2009 of a comparable $150 million charge in 2008

related to settlement of a purchase commitment, partially offset by a decrease in gross margin, driven by

the 41% decrease in net sales.

•In Our Home and Networks Mobility Business: Net sales were $8.0 billion, a decrease of 21% compared

to net sales of $10.1 billion in 2008. The decrease in net sales reflects a 22% decrease in net sales in the

networks business and a 21% decrease in net sales in the home business. On a geographic basis, net sales

decreased in all regions.

Operating earnings were $558 million in 2009, a decrease of 39% compared to operating earnings of

$918 million in 2008. The decrease in operating earnings was primarily due to a decrease in gross margin,

driven by the 21% decrease in net sales, partially offset by a favorable product mix. Also contributing to

the decrease in operating earnings was: (i) a $75 million charge related to a legal settlement, and

(ii) $39 million of charges related to a facility impairment. These factors were partially offset by decreases

in both R&D and SG&A expenses, reflecting savings from cost-reduction initiatives.

•In Our Enterprise Mobility Solutions Business: Net sales were $7.0 billion in 2009, a decrease of 13%

compared to net sales of $8.1 billion in 2008. On a geographic basis, net sales decreased in North

America, EMEA and Latin America, partially offset by increased net sales in Asia.

Operating earnings were $1.1 billion in 2009, a decrease of 29% compared to operating earnings of

$1.5 billion in 2008. The decrease in operating earnings was primarily due to a decrease in gross margin,

driven by the 13% decrease in net sales and an unfavorable product mix. Also contributing to the decrease

in operating earnings was an increase in reorganization of business charges, relating primarily to higher

employee severance costs. These factors were partially offset by decreased SG&A and R&D expenditures,

primarily related to savings from cost-reduction initiatives.

What were our major challenges and accomplishments in 2009?

•In Our Mobile Devices Business: 2009 was a year of significant change in the Mobile Devices business,

including transitioning the product portfolio, restructuring the business and implementing operational

improvements. From a portfolio perspective, the Mobile Devices business made significant progress on its

3G smartphone strategy by reducing the number of software platforms across the product portfolio, using

Android, a Google-developed, royalty-free operating system platform for smartphones, and reducing the

number of feature phone devices in the portfolio. During this period of change, Mobile Devices increased

its focus in priority markets, including North America and Latin America, and parts of Asia, including

China. Demand for Mobile Devices’ wireless handsets declined in 2009 primarily due to limited product

offerings in feature phones and smartphones as the Company implemented its strategy to transition its