Motorola 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(ii) $186 million of impairment charges on Sigma Fund investments, (iii) $101 million of losses on Sigma Fund

investments, and (iv) $84 million of foreign currency losses, partially offset by: (i) a $237 million curtailment gain

associated with the decision to freeze benefit accruals for U.S. pension plans, (ii) $56 million of gains related to

the extinguishment of a liability, (iii) $24 million of gains relating to several interest rate swaps not designated as

hedges, and (iv) a $14 million gain related to the extinguishment of a portion of the Company’s outstanding long-

term debt. The net income in 2007 was primarily comprised of $97 million of foreign currency gains, partially

offset by: (i) $44 million of investment impairment charges, and (ii) $18 million of impairment charges on Sigma

Fund investments.

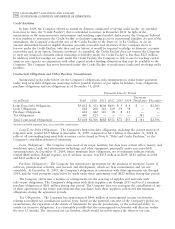

Effective Tax Rate

The Company recorded $1.6 billion of net tax expense in 2008, resulting in a negative effective tax rate of

(61)%, compared to $285 million of net tax benefits, resulting in an effective tax rate of 73%, in 2007. The

Company’s effective tax rate for 2008 was less than the U.S. statutory tax rate of 35% primarily due to the

recording of a $2.1 billion non-cash tax charge to establish deferred tax valuation allowances against a portion of

the Company’s U.S. deferred tax assets and the recording of non-deductible goodwill impairment charges.

The Company’s 2007 effective tax rate was greater than the U.S. statutory tax rate of 35% primarily due to

the reversal of deferred tax valuation allowances and an increase in research tax credits.

Loss from Continuing Operations

The Company incurred a net loss from continuing operations before income taxes of $2.6 billion in 2008,

compared with a net loss from continuing operations before income taxes of $390 million in 2007. After taxes,

the Company incurred a net loss from continuing operations of $4.2 billion, or $1.87 per diluted share, in 2008,

compared to a net loss from continuing operations of $105 million, or $0.05 per diluted share, in 2007.

The increase in the loss from continuing operations before income taxes in 2008 compared to 2007 was

primarily attributed to: (i) a $1.6 billion decrease in gross margin, (ii) a $1.4 billion increase in Other charges,

(iii) a $398 million increase in charges classified as Other, as presented in Other income (expense), and (iv) a

$43 million decrease in net interest income. These factors were partially offset by: (i) a $762 million decrease in

SG&A expenses, (ii) a $320 million decrease in R&D expenditures, and (iii) a $32 million increase in gains on

the sale of investments and businesses.

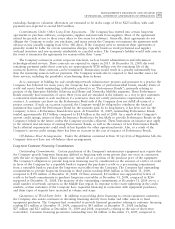

Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the ‘‘Severance Plan’’), which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in

the event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. Effective

August 1, 2009, the Company amended and restated the Severance Plan. Under the amended Severance Plan,

severance benefits will be paid in bi-weekly installments to impacted employees rather than in lump sum

payments. The Company recognizes termination benefits based on formulas per the Severance Plan at the point in

time that future settlement is probable and can be reasonably estimated based on estimates prepared at the time a

restructuring plan is approved by management. Exit costs consist of future minimum lease payments on vacated

facilities and other contractual terminations. At each reporting date, the Company evaluates its accruals for

employee separation and exit costs to ensure the accruals are still appropriate. In certain circumstances, accruals

are no longer needed because of efficiencies in carrying out the plans or because employees previously identified

for separation resigned from the Company and did not receive severance or were redeployed due to circumstances

not foreseen when the original plans were initiated. In these cases, the Company reverses accruals through the

consolidated statements of operations where the original charges were recorded when it is determined they are no

longer needed.

The Company realized cost-saving benefits of approximately $266 million in 2009 from the plans that were

initiated during 2009, representing: (i) $119 million of savings in R&D expenditures, (ii) $95 million of savings

in SG&A expenses, and (iii) $52 million of savings in Costs of sales. Beyond 2009, the Company expects the

reorganization plans initiated during 2009 to provide annualized cost savings of approximately $555 million,

representing: (i) $242 million of savings in R&D expenditures, (ii) $196 million of savings in SG&A expenses,

and (iii) $117 million of savings in Cost of sales.