Kroger 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-34

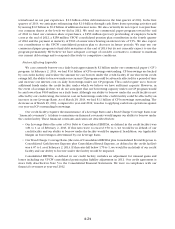

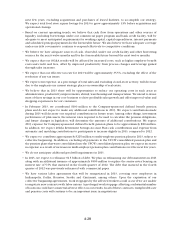

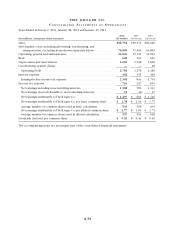

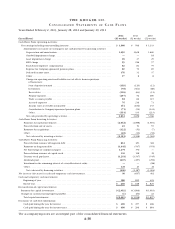

THE KROGER CO.

CO N S O L I D A T E D S T A T E M E N T S O F O P E R A T I O N S

Years Ended February 2, 2013, January 28, 2012 and January 29, 2011

(In millions, except per share amounts)

2012

(53 weeks)

2011

(52 weeks)

2010

(52 weeks)

Sales ........................................................ $96,751 $90,374 $82,049

Merchandise costs, including advertising, warehousing, and

transportation, excluding items shown separately below............ 76,858 71,494 63,803

Operating, general and administrative ............................. 14,849 15,345 13,823

Rent ........................................................ 628 619 623

Depreciation and amortization ................................... 1,652 1,638 1,600

Goodwill impairment charge .................................... —— 18

Operating Profit ............................................. 2,764 1,278 2,182

Interest expense .............................................. 462 435 448

Earnings before income tax expense ............................. 2,302 843 1,734

Income tax expense............................................ 794 247 601

Net earnings including noncontrolling interests .................... 1,508 596 1,133

Net earnings (loss) attributable to noncontrolling interests............ 11 (6) 17

Net earnings attributable to The Kroger Co......................... $ 1,497 $ 602 $ 1,116

Net earnings attributable to The Kroger Co. per basic common share.... $ 2.78 $ 1.01 $ 1.75

Average number of common shares used in basic calculation .......... 533 590 635

Net earnings attributable to The Kroger Co. per diluted common share .. $ 2.77 $ 1.01 $ 1.74

Average number of common shares used in diluted calculation ........ 537 593 638

Dividends declared per common share............................. $ 0.53 $ 0.44 $ 0.40

The accompanying notes are an integral part of the consolidated financial statements.