Kroger 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

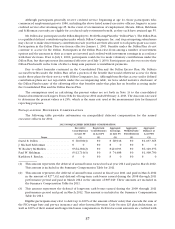

Although participants generally receive credited service beginning at age 21, those participants who

commenced employment prior to 1986, including the above listed named executive officers, began to accrue

creditedserviceafterattainingage25.Intheeventofaterminationofemployment,Messrs.Dillon,Heldman

and Schlotman currently are eligible for a reduced early retirement benefit, as they each have attained age 55.

Mr.DillonalsoparticipatesintheDillonEmployees’ProfitSharingPlan(the“DillonPlan”).TheDillonPlan

is a qualified defined contribution plan under which Dillon Companies, Inc. and its participating subsidiaries

maychoosetomakediscretionarycontributionseachyearthatarethenallocatedtoeachparticipant’saccount.

Participation in the Dillon Plan was frozen effective January 1, 2001. Benefits under the Dillon Plan do not

continuetoaccrueforMr.Dillon.ParticipantsintheDillonPlanelectfromamonganumberofinvestment

options and the amounts in their accounts are invested and credited with investment earnings in accordance

withtheirelections.PriortoJuly1,2000,participantscouldelecttomakevoluntarycontributionsunderthe

Dillon Plan, but that option was discontinued effective as of July 1, 2000. Participants can elect to receive their

Dillon Plan benefit in the form of either a lump sum payment or installment payments.

Due to offset formulas contained in the Consolidated Plan and the Dillon Excess Plan, Mr. Dillon’s

accrued benefits under the Dillon Plan offset a portion of the benefit that would otherwise accrue for them

under those plans for their service with Dillon Companies, Inc. Although benefits that accrue under defined

contribution plans are not reportable under the accompanying table, we have added narrative disclosure of

the Dillon Plan because of the offsetting effect that benefits under that plan has on benefits accruing under

the Consolidated Plan and the Dillon Excess Plan.

The assumptions used in calculating the present values are set forth in Note 13 to the consolidated

financial statements in Kroger’s Form 10-K for fiscal year 2012 ended February 2, 2013. The discount rate used

to determine the present values is 4.29%, which is the same rate used at the measurement date for financial

reporting purposes.

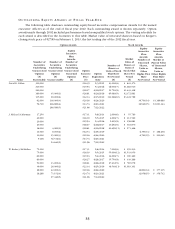

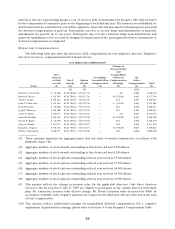

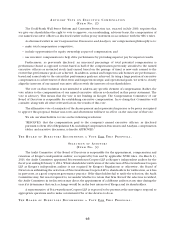

NO N Q U A L I F I E D D E F E R R E D C O M P E N S A T I O N

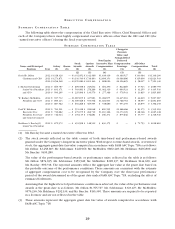

The following table provides information on nonqualified deferred compensation for the named

executive officers for 2012.

2012 NONQUALIFIED DEFERRED COMPENSATION

Executive

Contributions

in Last FY

Registrant

Contributions

in Last FY

Aggregate

Earnings

in Last FY

Aggregate

Withdrawals/

Distributions

Aggregate

Balance at

Last FYE

Name ($) ($) ($) ($) ($)

David B. Dillon .................... $ 60,000(1) $0 $ 68,918 $0 $1,037,365

J.MichaelSchlotman ............... $ 0 $0 $ 0 $0 $ 0

W.RodneyMcMullen ............... $364,381(2) $0 $413,093 $0 $6,329,976

Paul W. Heldman ................... $312,716(3) $0 $ 74,488 $0 $1,368,700

Kathleen S. Barclay ................. $ 0 $0 $ 0 $0 $ 0

(1) Thisamountrepresentsthedeferralofannualbonusearnedinfiscalyear2011andpaidinMarch2012.

This amount is included in the Summary Compensation Table for 2011.

(2) Thisamountrepresentsthedeferralofannualbonusearnedinfiscalyear2011andpaidinMarch2012

in the amount of $277,332 and deferral of long-term cash bonus earned during the 2008 through 2011

performanceperiodandpaidinMarch2012intheamountof$87,049.Theseamountsareincludedin

the Summary Compensation Table for 2011.

(3) This amount represents the deferral of long-term cash bonus earned during the 2008 through 2011

performanceperiodandpaidinMarch2012.ThisamountisincludedintheSummaryCompensation

Table for 2011.

Eligible participants may elect to defer up to 100% of the amount of their salary that exceeds the sum of

the FICA wage base and pre-tax insurance and other Internal Revenue Code Section 125 plan deductions, as

well as 100% of their annual and long-term bonus compensation. Deferral account amounts are credited with