Kroger 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-11

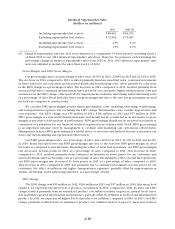

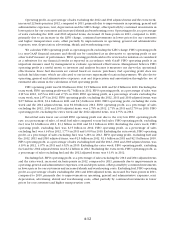

deli and bakery, and pharmacy. In 2010, our LIFO charge primarily resulted from annualized product cost

inflation related to meat, pharmacy and Company-manufactured products, partially offset by deflation in

grocery products.

Operating, General and Administrative Expenses

Operating, general and administrative (“OG&A”) expenses consist primarily of employee-related costs

such as wages, health care benefits and retirement plan costs, utilities and credit card fees. Rent expense,

depreciation and amortization expense, and interest expense are not included in OG&A.

OG&A expenses, as a percentage of sales, were 15.35% in 2012, 16.98% in 2011, and 16.85% in 2010.

Excluding the 2012 and 2011 adjusted items, OG&A expenses, as a percentage of sales, were 15.47% in 2012

and 15.92% in 2011. The growth in our retail fuel sales reduces our OG&A rate due to the very low OG&A

rate on retail fuel sales as compared to non-fuel sales. OG&A expenses, as a percentage of sales excluding

fuel and the 2012 adjusted items, decreased 39 basis points in 2012, compared to 2011. This decrease resulted

primarily from increased identical supermarket sales growth, productivity improvements, effective cost

controls at the store level, the benefit received in lower operating expenses from the consolidation of four

UFCW multi-employer pension plans in the prior year and decreased incentive compensation, offset partially

by increased healthcare costs. OG&A expenses, as a percentage of sales excluding fuel and the 2011 adjusted

item, decreased 25 basis points in 2011, compared to 2010. The 2011 decrease, compared to 2010, resulted

primarily from increased identical supermarket sales growth, productivity improvements and strong cost

controls at the store level, offset partially by increased credit and debit card fees, incentive compensation and

health care costs.

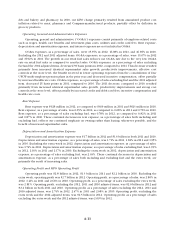

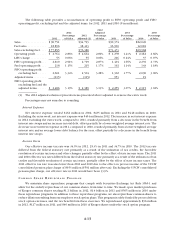

Rent Expense

Rent expense was $628 million in 2012, as compared to $619 million in 2011 and $623 million in 2010.

Rent expense, as a percentage of sales, was 0.65% in 2012, as compared to 0.68% in 2011 and 0.76% in 2010.

Rent expense, as a percentage of sales excluding fuel, was 0.78% in 2012, as compared to 0.82% in 2011

and 0.87% in 2010. These continual decreases in rent expense, as a percentage of sales both including and

excluding fuel, reflects our continued emphasis on owning rather than leasing, whenever possible, and the

benefit of increased supermarket sales.

Depreciation and Amortization Expense

Depreciation and amortization expense was $1.7 billion in 2012 and $1.6 billion in both 2011 and 2010.

Depreciation and amortization expense, as a percentage of sales, was 1.71% in 2012, 1.81% in 2011 and 1.95%

in 2010. Excluding the extra week in 2012, depreciation and amortization expense, as a percentage of sales,

was 1.74% in 2012. Depreciation and amortization expense, as a percentage of sales excluding fuel, was 1.99%

in 2012, 2.10% in 2011 and 2.17% in 2010. Excluding the extra week in 2012, depreciation and amortization

expense, as a percentage of sales excluding fuel, was 2.03%. These continual decreases in depreciation and

amortization expense, as a percentage of sales both including and excluding fuel and the extra week, are

primarily the result of increasing sales.

Operating Profit and FIFO Operating Profit

Operating profit was $2.8 billion in 2012, $1.3 billion in 2011 and $2.2 billion in 2010. Excluding the

extra week, operating profit was $2.7 billion in 2012. Operating profit, as a percentage of sales, was 2.86% in

2012, 1.41% in 2011 and 2.66% in 2010. Operating profit, as a percentage of sales excluding the extra week,

was 2.81%. Operating profit, excluding the 2012, 2011 and 2010 adjusted items, was $2.6 billion in 2012 and

$2.2 billion in both 2011 and 2010. Operating profit, as a percentage of sales excluding the 2012, 2011 and

2010 adjusted items, was 2.74% in 2012, 2.47% in 2011 and 2.68% in 2010. Operating profit, excluding the

extra week and the 2012 adjusted items, was $2.5 billion in 2012. Operating profit, as a percentage of sales

excluding the extra week and the 2012 adjusted items, was 2.69% in 2012.