Kroger 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-22

Consequently, the amendments change some fair value measurement principles and disclosure requirements.

The implementation of the amended accounting guidance did not have a material effect on our consolidated

financial position or results of operations.

RE C E N T L Y I S S U E D A C C O U N T I N G S T A N D A R D S

As discussed above under Recently Adopted Accounting Standards, in December 2011 the FASB deferred

certain provisions of its 2011 rule amendments dealing with reclassification adjustments. In February 2013, the

FASB amended its standards on comprehensive income by requiring disclosure in the footnotes of information

about amounts reclassified out of accumulated other comprehensive income by component. Specifically, the

amendment will require disclosure of the line items of net income in which the item was reclassified only if

it is reclassified to net income in its entirety in the same reporting period. It will also require cross reference

to other disclosures for amounts that are not reclassified in their entirety in the same reporting period. The

new disclosures will be required for us prospectively only for annual periods beginning February 3, 2013 and

interim periods within those annual periods.

LI Q U I D I T Y A N D C A P I T A L R E S O U R C E S

Cash Flow Information

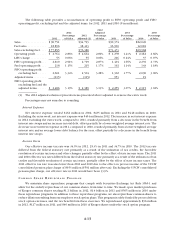

Net cash provided by operating activities

We generated $2.8 billion of cash from operations in 2012, compared to $2.7 billion in 2011 and $3.4 billion

in 2010. The cash provided by operating activities came from net earnings including non-controlling interests

adjusted primarily for non-cash expenses of depreciation and amortization, the LIFO charge and changes

in working capital. The increase in net cash provided by operating activities in 2012, compared to 2011,

resulted primarily due to an increase in net earnings including non-controlling interests, offset by a decline

in long-term liabilities and changes in working capital. The decline in long-term liabilities in 2012 is due to

the investment returns of our Company-sponsored pension plans during the year and our funding of the

remaining UAAL commitment, partially offset by a lower discount rate on our Company-sponsored pension

plans. The decrease in net cash provided by operating activities in 2011, compared to 2010, was primarily due

to the decline in net earnings including non-controlling interests, due to the UFCW consolidated pension plan

charge, and changes in working capital, offset by an increase in long-term liabilities. The increase in long-term

liabilities in 2011 was due to establishing a liability for our remaining estimated commitment for the UAAL in

excess of the cash contribution and a lower discount rate on our Company-sponsored pension plans, offset by

the investment returns of our Company-sponsored pension plans during the year. Changes in working capital

also provided (used) cash from operating activities of ($332) million in 2012, compared to ($300) million

in 2011 and $698 million in 2010. The decrease in cash provided by changes in working capital for 2012,

compared to 2011, was primarily due to an increase in inventories and prepaid expenses, offset partially

by an increase in accrued expenses. Prepaid expenses increased in 2012, compared to 2011, due to Kroger

prefunding $250 million of employee benefits at the end of 2012. The decrease in cash provided by changes in

working capital for 2011, compared to 2010, was primarily due to an increase in inventories, offset partially by

increases in trade accounts payable and accrued expenses. These amounts are also net of cash contributions

to our Company-sponsored defined benefit pension plans totaling $71 million in 2012, $52 million in 2011

and $141 million in 2010.

The amount of cash paid for income taxes increased in 2012, compared to 2011, primarily due to an

increase in net earnings including non-controlling interests. The amount of cash paid for income taxes

decreased in 2011, compared to 2010, primarily due to a decrease in net earnings including non-controlling

interests and from the bonus depreciation deductions allowed by the 2010 Tax Relief Act for property placed

into service in 2011.