Kroger 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-54

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

Cash and Temporary Cash Investments, Deposits In-Transit, Receivables, Prepaid and Other Current

Assets, Trade Accounts Payable, Accrued Salaries and Wages and Other Current Liabilities

The carrying amounts of these items approximated fair value.

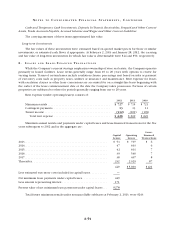

Long-term Investments

The fair values of these investments were estimated based on quoted market prices for those or similar

investments, or estimated cash flows, if appropriate. At February 2, 2013 and January 28, 2012, the carrying

and fair value of long-term investments for which fair value is determinable were $44 and $50, respectively.

8 . L E A S E S A N D L E A S E - F I N A N C E D T R A N S A C T I O N S

While the Company’s current strategy emphasizes ownership of store real estate, the Company operates

primarily in leased facilities. Lease terms generally range from 10 to 20 years with options to renew for

varying terms. Terms of certain leases include escalation clauses, percentage rent based on sales or payment

of executory costs such as property taxes, utilities or insurance and maintenance. Rent expense for leases

with escalation clauses or other lease concessions are accounted for on a straight-line basis beginning with

the earlier of the lease commencement date or the date the Company takes possession. Portions of certain

properties are subleased to others for periods generally ranging from one to 20 years.

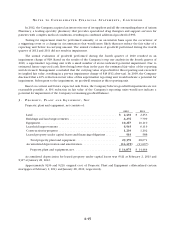

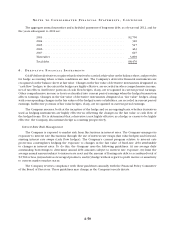

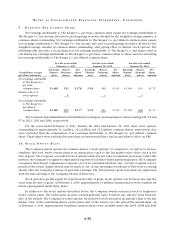

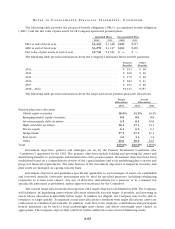

Rent expense (under operating leases) consists of:

2012 2011 2010

Minimum rentals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 727 $ 715 $ 721

Contingent payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 13 11

Tenant income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (112) (109) (109)

Total rent expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 628 $ 619 $ 623

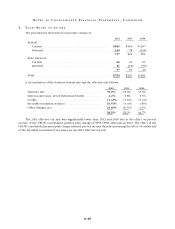

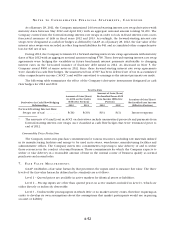

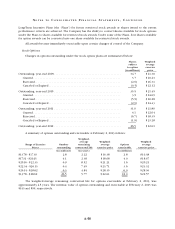

Minimum annual rentals and payments under capital leases and lease-financed transactions for the five

years subsequent to 2012 and in the aggregate are:

Capital

Leases

Operating

Leases

Lease-

Financed

Transactions

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 51 $ 707 $ 6

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 663 6

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42 601 7

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39 540 7

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 467 8

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 232 2,025 87

449 $5,003 $121

Less estimated executory costs included in capital leases . . . . . . . . . . . —

Net minimum lease payments under capital leases . . . . . . . . . . . . . . . . 449

Less amount representing interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 171

Present value of net minimum lease payments under capital leases . . . $278

Total future minimum rentals under noncancellable subleases at February 2, 2013, were $243.