Kroger 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

interest at the rate representing Kroger’s cost of ten-year debt as determined by Kroger’s CEO and reviewed

by the Compensation Committee prior to the beginning of each deferral year. The interest rate established for

deferral amounts for each deferral year will be applied to those deferral amounts for all subsequent years until

the deferred compensation is paid out. Participants can elect to receive lump sum distributions or quarterly

installments for periods up to ten years. Participants also can elect between lump sum distributions and

quarterly installments to be received by designated beneficiaries if the participant dies before distribution of

deferred compensation is completed.

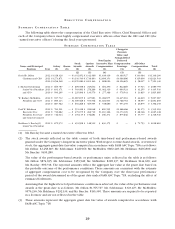

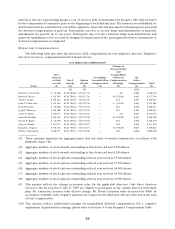

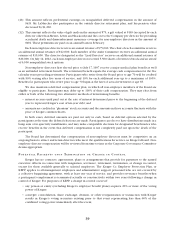

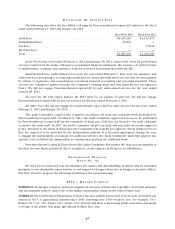

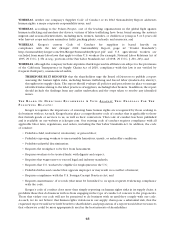

DI R E C T O R C O M P E N S A T I O N

The following table describes the fiscal year 2012 compensation for non-employee directors. Employee

directors receive no compensation for their Board service.

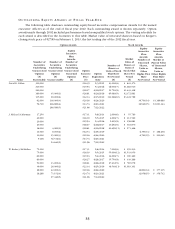

2012 DIRECTOR COMPENSATION

Name

Fees

Earned

or Paid

in Cash

($)

Stock

Awards

($)

Option

Awards

($)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($)

All

Other

Compensation

($)

Total

($)

(1) (1) (12)

Reuben V. Anderson ....... $ 76,008 $120,780(2) $29,217(4) — —(9) $465 $226,470

Robert D. Beyer. . . . . . . . . . . $ 81,105 $120,780(3) $29,217(4) — $ 5,972(10) $465 $237,539

Susan J. Kropf ............ $ 86,142 $120,780(3) $29,217(5) — N/A $465 $236,604

JohnT.LaMacchia. . . . . . . . . $ 81,105 $120,780(2) $29,217(4) — $ 415(11) $465 $231,982

David B. Lewis ........... $ 76,008 $120,780(2) $29,217(4) — N/A $266 $226,271

JorgeP.Montoya .......... $ 88,169 $120,780(2) $29,217(5) — N/A $465 $238,631

ClydeR.Moore ........... $ 83,073 $120,780(3) $29,217(4) — —(9) $465 $233,535

SusanM.Phillips .......... $ 86,142 $120,780(2) $29,217(6) — $1,995(10) $465 $238,599

Steven R. Rogel ........... $ 76,008 $120,780(2) $29,217(4) — N/A $465 $226,470

James A. Runde ........... $ 83,073 $120,780(2) $29,217(7) — N/A $465 $233,535

Ronald L. Sargent ......... $ 98,304 $120,780(3) $29,217(7) — $2,058(10) $465 $250,824

BobbyS.Shackouls ........ $118,573 $120,780(3) $29,217(8) — N/A $266 $268,836

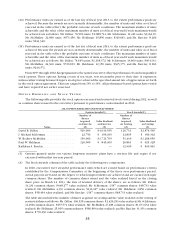

(1) Theseamountsrepresenttheaggregategrantdatefairvalueofawardscomputedinaccordancewith

FASB ASC Topic 718.

(2) Aggregatenumberofstockawardsoutstandingatfiscalyearendwas5,500shares.

(3) Aggregatenumberofstockawardsoutstandingatfiscalyearendwas8,250shares.

(4) Aggregatenumberofstockoptionsoutstandingatfiscalyearendwas57,500shares.

(5) Aggregatenumberofstockoptionsoutstandingatfiscalyearendwas37,500shares.

(6) Aggregatenumberofstockoptionsoutstandingatfiscalyearendwas46,500shares.

(7) Aggregatenumberofstockoptionsoutstandingatfiscalyearendwas42,500shares.

(8) Aggregatenumberofstockoptionsoutstandingatfiscalyearendwas47,500shares.

(9) This amount reflects the change in pension value for the applicable directors. Only those directors

elected to the Board prior to July 17, 1997 are eligible to participate in the outside director retirement

plan.Mr.Anderson’spensionvaluedidnotchange.Mr.Moore’spensionvaluedecreasedby$800.In

accordance with SEC rules, negative amounts are required to be disclosed, but not reflected in the sum

of total compensation.

(10) This amount reflects preferential earnings on nonqualified deferred compensation. For a complete

explanation of preferential earnings, please refer to footnote 5 to the Summary Compensation Table.