Kroger 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-48

NO T E S T O C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S , CO N T I N U E D

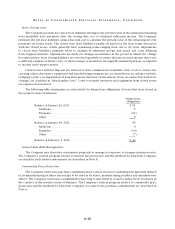

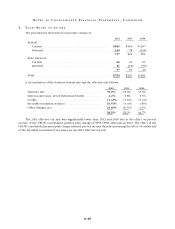

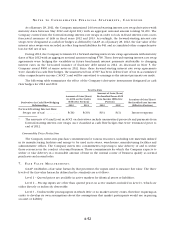

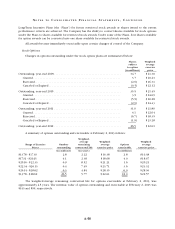

A reconciliation of the beginning and ending amount of unrecognized tax benefits, including positions

impacting only the timing of tax benefits, is as follows:

2012 2011 2010

Beginning balance ..................................... $310 $285 $ 544

Additions based on tax positions related to the current year .... 45 24 38

Reductions based on tax positions related to the current year... (9) — (273)

Additions for tax positions of prior years ................... 124 13

Reductions for tax positions of prior years .................. (27) (11) (21)

Settlements........................................... (21) (12) (16)

Ending balance........................................ $299 $310 $ 285

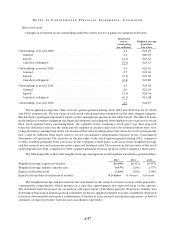

In prior periods, the above table included state net operating losses which the Company believed would

expire unused. These net operating losses are no longer included in the above table. Instead, the tax benefit

of these losses has been included in the deferred tax table shown above and a valuation allowance has been

recorded against them as described above.

The Company does not anticipate that changes in the amount of unrecognized tax benefits over the next

twelve months will have a significant impact on its results of operations or financial position.

As of February 2, 2013, January 28, 2012 and January 29, 2011, the amount of unrecognized tax benefits

that, if recognized, would impact the effective tax rate was $70, $81 and $85 respectively. The Company’s

disclosure of these amounts for 2011 and 2010 has changed due to the Company reclassifying state operating

losses as described above.

To the extent interest and penalties would be assessed by taxing authorities on any underpayment

of income tax, such amounts have been accrued and classified as a component of income tax expense.

During the years ended February 2, 2013, January 28, 2012 and January 29, 2011, the Company recognized

approximately $(8), $(24) and $(2), respectively, in interest and penalties (recoveries). The Company had

accrued approximately $33 and $54 for the payment of interest and penalties as of February 2, 2013 and

January 28, 2012, respectively.

As of February 2, 2013, the Internal Revenue Service had concluded its field examination of the Company’s

2008 and 2009 federal tax returns and is currently auditing years 2010 and 2011. The 2010 and 2011 audit

is expected to be completed in 2014. The Company has filed an administrative appeal within the Internal

Revenue Service protesting certain adjustments proposed by the Internal Revenue Service as a result of their

field work.

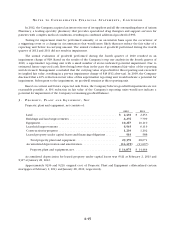

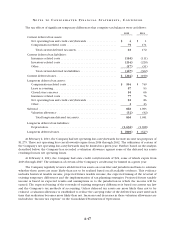

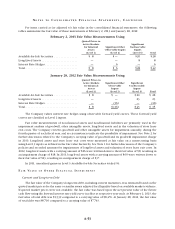

5 . D E B T O B L I G A T I O N S

Long-term debt consists of:

2012 2011

0.40% to 0.48% Commercial paper due through March 2013......... $ 1,645 $ 370

2.20% to 8.00% Senior notes due through 2042 ................... 6,587 7,078

5.00% to 12.75% Mortgages due in varying amounts through 2034 .... 60 65

Other .................................................... 184 230

Total debt ................................................. 8,476 7,743

Less current portion ........................................ (2,700) (1,275)

Total long-term debt......................................... $ 5,776 $ 6,468